E-File ACA Forms for the 2024 Tax Year

If you are an employer, insurer, or third-party administrator, e-file your ACA Forms 1095-B and 1095-C accurately with TaxZerone.

E-File Your ACA Forms at the best price with TaxZerone

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Pricing Includes

Bulk Filing

Schedule Filing

Transmittal Form 1094-B & Form 1094-C

USPS Address Validation

Error Checks

Expert Support

Add-ons Available

| Electronic Delivery | $ 0.50/form |

| Postal Mailing | $1.75/form |

E-File ACA Forms Quickly with TaxZerone

Who Should File ACA Forms?

Form 1095-B

- Health insurance providers and small employers (under 50 full-time employees) that sponsor self-insured health plans.

- Government agencies (like Medicaid or CHIP programs) providing health coverage.

Form 1095-C

- Applicable Large Employers (ALEs) – employers with 50 or more full-time employees, including full-time equivalents.

- ALEs must file for each full-time employee, regardless of whether they offered coverage or not.

Why File ACA Forms?

- Verify Health Coverage

ACA forms provide proof of Minimum Essential Coverage (MEC) and ensure individuals can confirm they were covered during the year. - Employer Shared Responsibility

It helps the IRS determine if an Employer Shared Responsibility Payment applies. - Employee & Individual Records

Employees and covered individuals use the forms to understand their coverage. - Transparency & Reporting Accuracy

Prevents discrepancies in health coverage and tax credit eligibility.

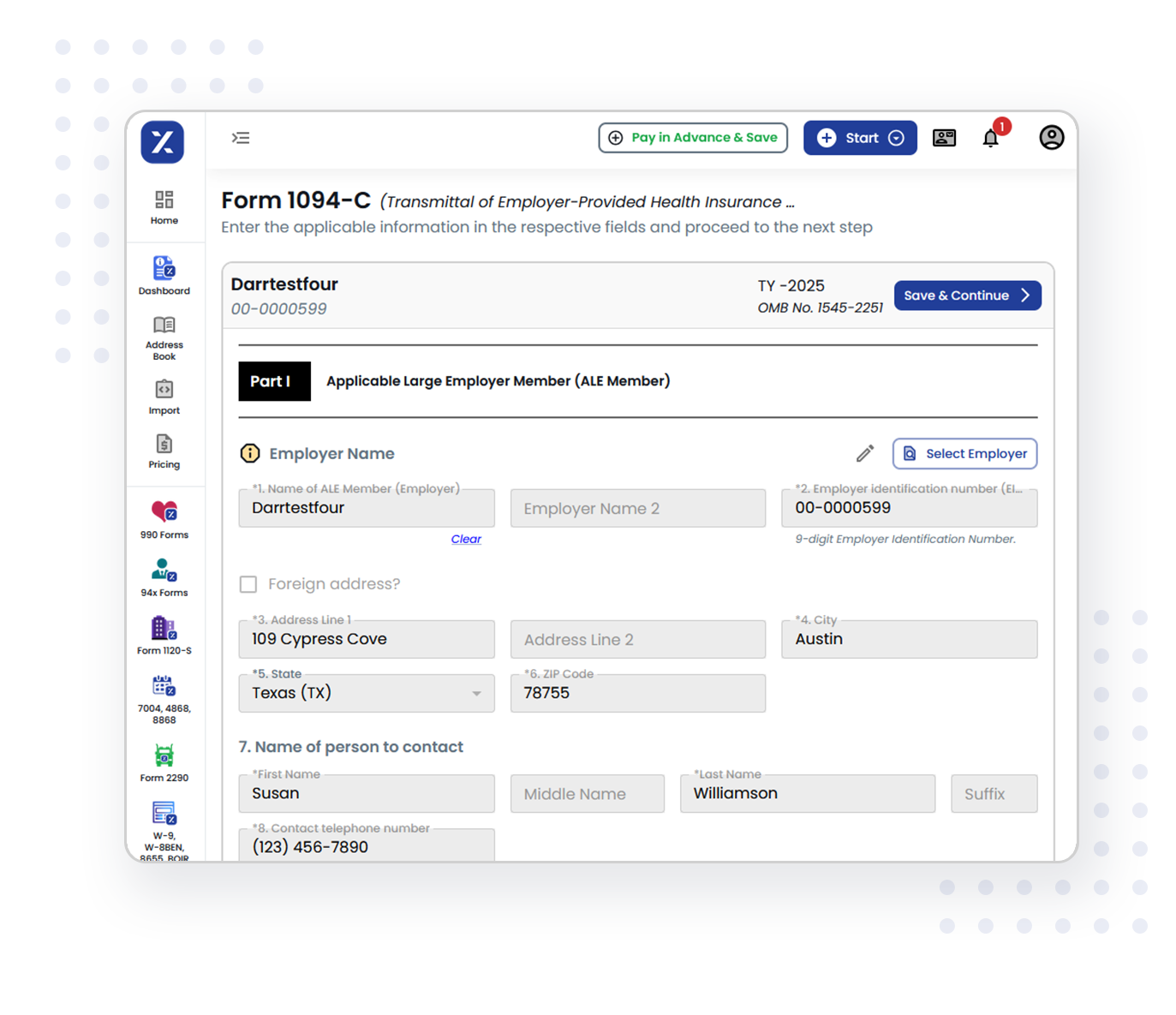

How to E-File 1095-B/1095-C forms using TaxZerone?

Enter all the required fields

Select the applicable form and enter all the required details

Transmit to the IRS

Review and transmit your return to the IRS.

Send Recipient’s Copy

Deliver your recipient’s copy securely through ZeroneVault.

Benefits of E-filing ACA forms with TaxZerone?

IRS Authorized

TaxZerone is an IRS authorized e-file provider. We make sure your ACA forms (1095-B or 1095-C) are filed accurately and securely with the IRS.

ZeroneVault

Send your recipient copies quickly and securely using ZeroneVault for electronic delivery or choose traditional postal mail for physical copies.

Real-Time Updates

TaxZerone keeps you in the loop at every step, right from filing your return to receiving IRS acceptance by sending timely updates straight to your email.

Affordable Pricing

Whether you are filing a single form or handling bulk submissions, we offer competitive pricing in the industry.

Schedule Filing

Our schedule filing feature will let you prepare the returns in advance. You can choose the exact date to submit the return with the IRS.

Expert Support

Got Questions? Our expert support team is here to help you by email, phone (English & Spanish), and live Chat.

Hear What Our Clients Say About Us

- Ethan Brooks

- Henry Mitchell

- Amelia Brown

Common Use Cases

Form 1095-B

- Health insurance providers (like insurance companies or small self-funded employers) to report individuals who had minimum essential coverage (MEC).

- Provides proof of coverage for individuals to avoid ACA penalties (when applicable).

- Helps individuals confirm they had coverage for tax return purpose

Form 1095-C

- Applicable Large Employers (ALEs) with 50 or more full-time employees. It reports what coverage was offered to employees and whether they enrolled.

- Provides employees with details of their coverage or eligibility for marketplace credits.

- Helps IRS determine employer shared responsibility payments.

Competitor Comparison: Why Choose TaxZeronefor ACA E-Filing

| Feature | TaxZerone | Other E-file Platforms | Paper Filing (Manual) |

|---|---|---|---|

| IRS-Authorized E-File Provider | Yes | Varies | No |

| Form Coverage | Supports Form 1095-B/1094-B and Form 1095-C/1094-C | Limited coverage | Not Applicable |

| Pricing | As low as $0.59 per form (for 1000+) | Higher filing fees, hidden charges | Printing, postage & manual costs |

| Real-Time Error Validation | Automatic validation before IRS submission | Limited checks | Manual review only |

| Bulk Upload | Accepts extension files | Limited or unavailable | Not possible |

| Corrections & Re-file | Free corrections for rejected returns | Extra charges | Manual corrections, resubmission delays |

| Delivery Options | E-delivery & Postal Mailing | Limited | Manual printing & mailing |

| Recipient Access Portal | ZeroneVault (Secure & IRS-compliant portal) | Not available | Not available |

| Filing Scheduler | Schedule filings in advance | Limited | Not possible |

| Reminders | Email reminders sent before IRS deadlines | Not available | Not available |

| Customer Support | U.S. based support | Limited or email-only | None |

Ready to E-File ACA forms?

E-File your ACA forms on time and stay compliant with the IRS using an affordable e-file service provider – TaxZerone.

Frequently Asked Questions

1. What are ACA Forms?

- Form 1095-B: Health Coverage

- Form 1095-C: Employer-Provided Health Insurance Offer and Coverage

2. Who needs to file ACA Forms?

- ACA Form 1095-B is filed by

- Health Coverage Providers

- Self-Insured Employers

- Small Employers with Self-Insured Plans

- Health Insurance Issuers and Carriers

- Plan Sponsors of Self-Insured Employer Coverage

- Government Employers

- State Agencies

- Designated Health Plans

- ACA Form 1095-C is filed by

- Applicable Large Employer (ALE)

3. When is the deadline for filing ACA forms?

| ACA Form | Deadline |

|---|---|

| Recipient copy | January 31 |

| Paper filing | February 28 |

| E-filing | March 31 |

New here?

Get the support you need.

Still have questions about ACA forms?

Reach out to our friendly support team for all your Queries.