File Every Business Tax Return from One Secure Platform

Partnerships, S-corps, and complex business entities trust TaxZerone to file IRS forms accurately, on time, and without tax software headaches.

Your Business Doesn’t File One Form — It Files a Tax System

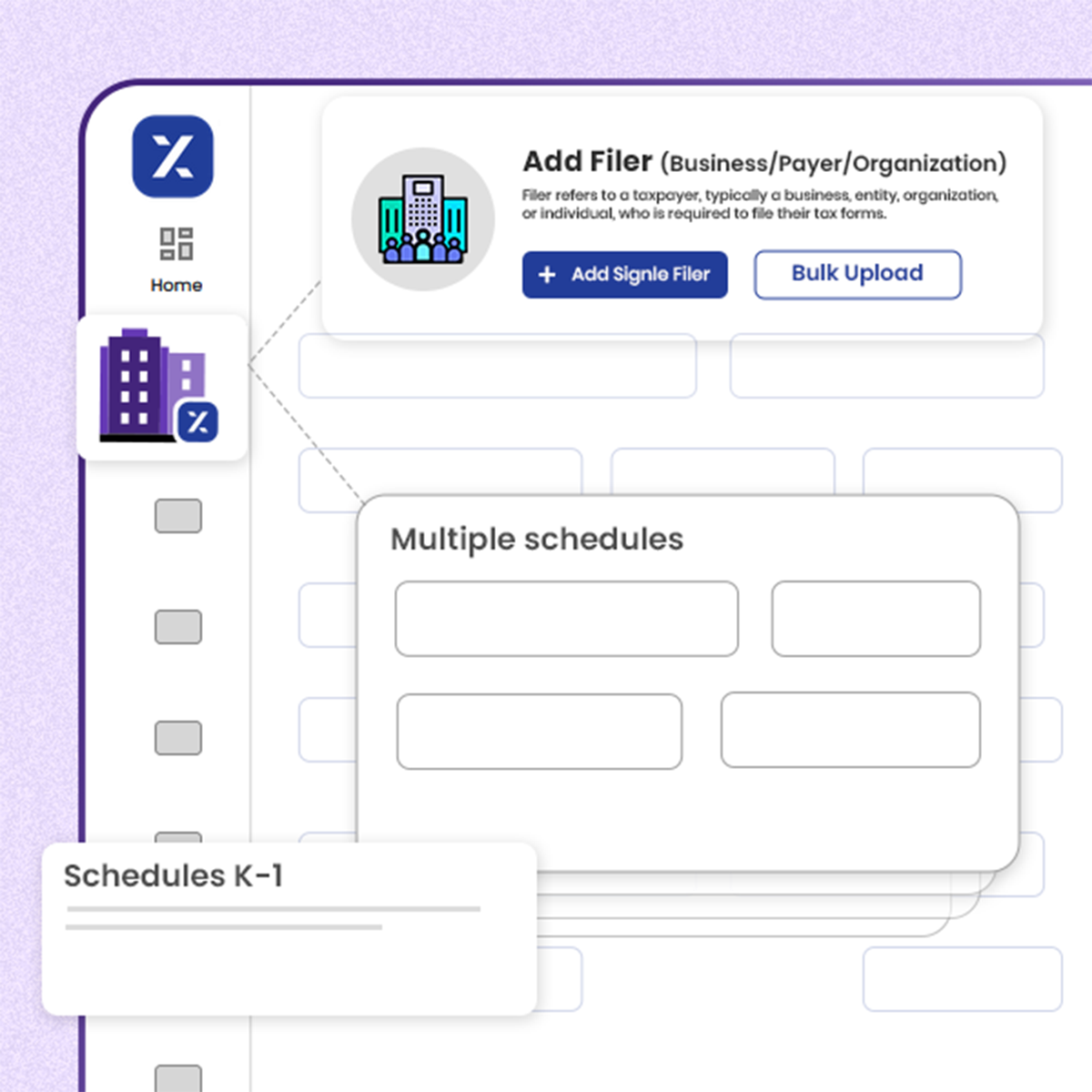

Most businesses don’t just file a return. They file:

- One entity tax return

- Multiple schedules

- Partner or shareholder statements

- Payroll tax forms

- And sometimes extension forms

TaxZerone was built to handle entire business tax workflows, not just single documents.

Whether you’re a partnership issuing K-1s or an S-corp reporting shareholder income, this platform keeps everything connected, accurate, and IRS-compliant.

Supported Forms

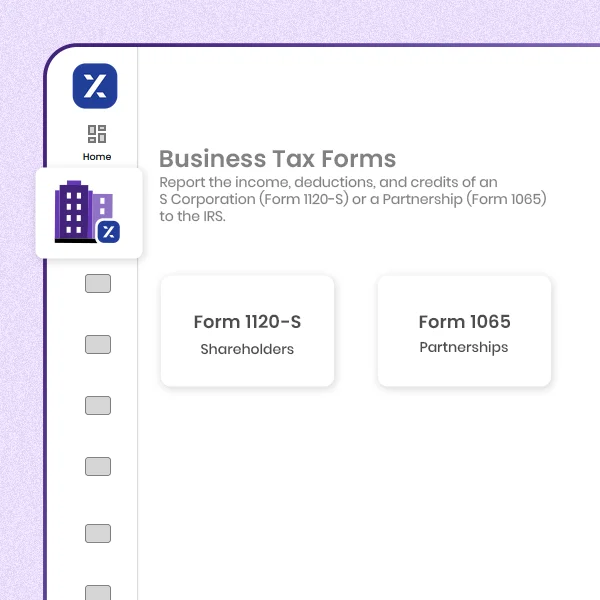

Business Tax Forms You Can File Right Now

| Business Type | Form | What It Covers |

|---|---|---|

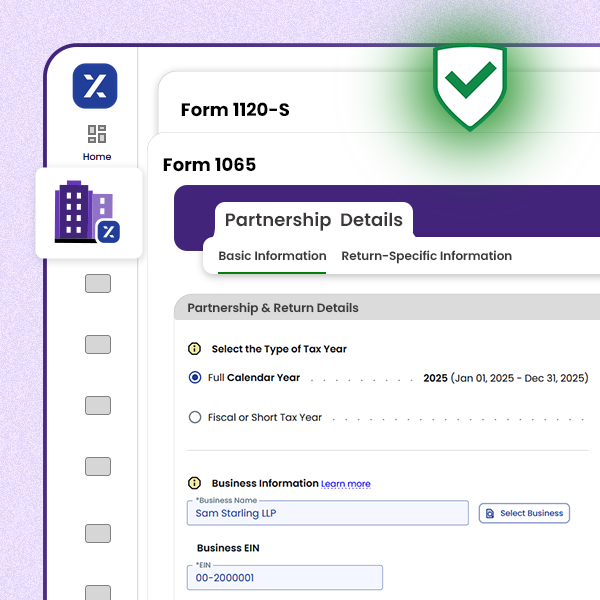

| Partnerships & Multi-member LLCs | Form 1065 | Partnership income and partner allocations |

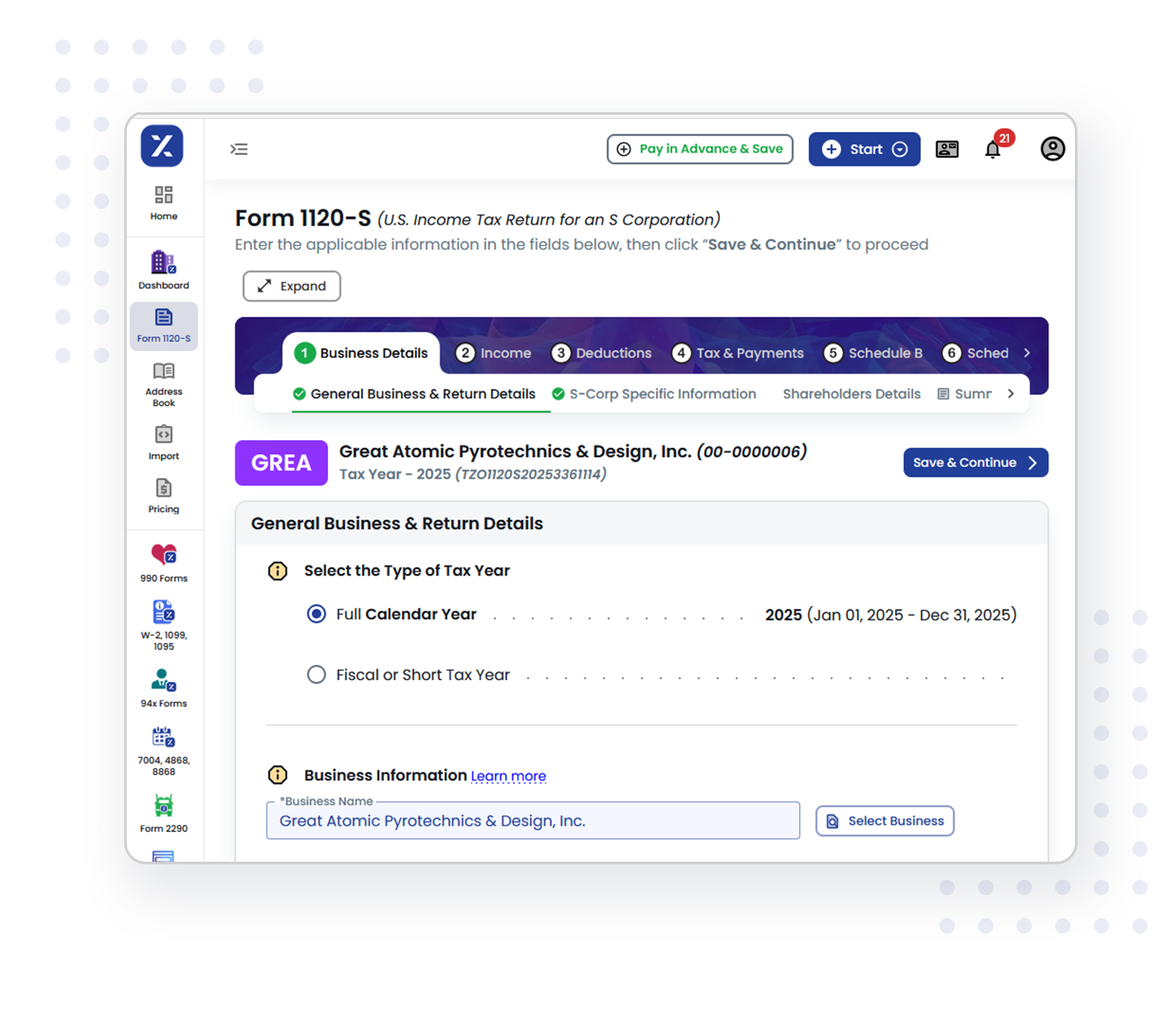

| S Corporations | Form 1120-S | Corporate income passed to shareholders |

| Extensions (All Businesses) | Form 7004 | Automatic filing extension |

Who This Platform Is Built For

Built for Real Business Owners — Not Just Tax Experts

- Small Business Owners

File your business return without hiring CPAs. - Partnerships & LLCs

Automatically generate K-1s and allocate income correctly. - S-Corporations

File your corporate return and shareholder reports in one flow. - CPAs & Tax Firms

Handle multiple client filings from a single dashboard.

How Business Filing Works on TaxZerone

Choose Your Business Type

Tell us whether you’re a partnership, S-corp, or other entity.

Enter Business & Financial Data

Our system knows which IRS forms and schedules your business needs.

We Build the IRS-Ready Return

TaxZerone structures everything according to IRS e-file standards.

Submit & Track

File electronically and monitor acceptance from the IRS.

Top Reasons Businesses Choose TaxZerone

Get more than just e-filing. TaxZerone gives you a smarter, simpler way to handle every business tax return.

Business-Ready Filing

TaxZerone is designed for partnerships, S-corps, and growing entities. Our system understands business structures, schedules, and reporting requirements—so you don’t have to figure it out yourself.

Guided Business Workflows

Answer a few simple questions about your business, and we automatically guide you to the correct IRS forms, schedules, and supporting documents required for your entity type.

Smart Error Detection

Our built-in validations check for missing data, calculation errors, and IRS-rule mismatches before submission—helping prevent delays and rejections.

Fast & Secure IRS Submission

Your completed return is sent electronically to the IRS through secure, encrypted channels, ensuring speed, privacy, and full compliance.

Real-Time Filing Status

Get email alerts and in-account updates when your business return is received, accepted, or needs attention—no guesswork, no waiting.

Free Correction & Resubmission

If the IRS flags your return, you can make corrections and resubmit at no additional charge—so you stay compliant without paying twice.

Why This Is Better Than Traditional Tax Software

Why Businesses Are Switching to TaxZerone

Traditional Software

- You buy expensive software

- You choose forms manually

- Complex UI for accountants

- Separate extension tools

- Hard to manage multiple entities

TaxZerone

Better

- You only pay per filing

- System selects required forms

- Designed for both business owners and accountants

- Extensions included

- Centralized business dashboard

Trust & Compliance

Built for IRS-Level Accuracy

TaxZerone is an IRS-authorized e-file provider, meaning every business return is transmitted directly to the IRS using their secure electronic filing systems.

Your data is encrypted, validated, and verified before submission — reducing rejection and penalty risks.

Start Your Business Filing the Right Way

Begin your e-filing journey and complete your business return with ease.