E-file IRS Form 943 Online for the 2025 Tax Year

E-filing platform for agricultural employers to submit Form 943 with TaxZerone, reporting the annual federal tax withheld from wages paid to farmworkers.

File Form 943 with the IRS online at the best price!

Pay one flat rate for the best value—no hidden charges or complex pricing. With us, what you see is what you pay.

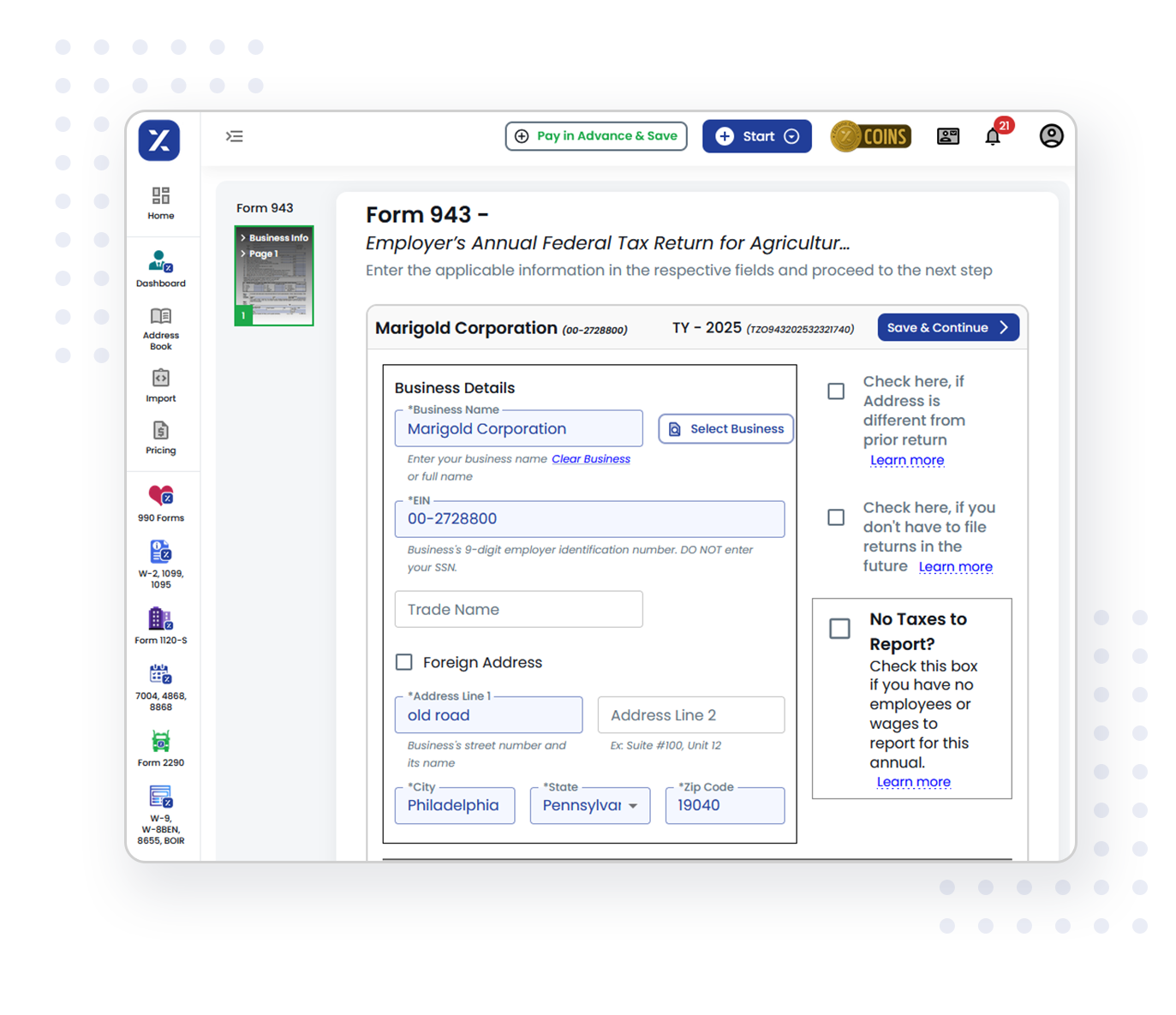

3 Simple Steps to E-file Form 943 for the 2025 Tax Year

Enter the Information

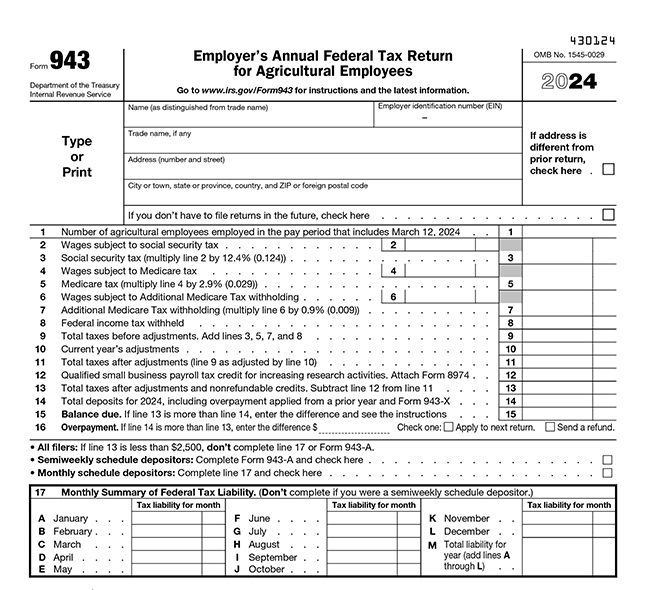

Provide the required details such as the number of agricultural employees, federal income taxes withheld, and total deposits.

Review and Transmit

Double-check all entered information and submit the completed Form 943 to the IRS securely.

Complete your Form 943 e-filing in minutes with TaxZerone—simple steps for a smooth process.

E-file Form 943Completed in just minutes.

Why choose TaxZerone for filing Form 943?

IRS-Authorized

Your tax filings are handled securely and fully compliant. E-file your 943 Form with TaxZerone with confidence, assured that it will be processed by the IRS without any issues.

FREE Online Signature PIN

Receive a FREE online signature PIN to sign and file IRS Form 943 electronically, eliminating the need for manual signatures.

Business Validation

Verify your form details with the IRS Business Validation feature to minimize errors, reduce rejections, and ensure approval on your first submission.

Includes Form 8453-EMP

Easily attach Form 8453-EMP to authorize your e-filed Form 943 with TaxZerone, simplifying the process for employers.

IRS Payment Options

Choose from IRS-approved payment options like EFW, EFTPS, and debit/credit card to settle your employment taxes quickly.

Internal Error Verification

TaxZerone's system identifies potential errors in your Form 943 to ensure accurate and error-free filing every time.

What details are required to submit Form 943 online?

- Employer Information:

- - Employer Identification Number (EIN)

- - Business name

- - Business address (including state and ZIP code)

- Farmworker Wage and Tax Information:

- - Agricultural Employees Count

- - Wages subject to social security tax

- - Wages subject to Medicare tax

- - Federal Income Tax Withheld

- - Total deposits

Start your IRS tax Form 943 filing today with easy step-by-step instruction

E-file Form 943 Now!See How Tax Filing Became Easier for Business Owners

See why businesses trust TaxZerone for smooth, simple, and reliable tax filing.

— Ellis Monroe

— Tatum Avery

— Ember Hart

Supporting Forms

Form 943-A

Agricultural Employer’s Record of Federal Tax Liability - Used by semiweekly schedule depositors to report their daily federal tax liability for the year.

Ready to simplify your Annual Payroll Tax Filing?

E-file your Form 943 with the IRS using TaxZerone and stay compliant with ease.

Helpful Resources for IRS Form 943

Form 943-X Instructions

Learn the step-by-step instructions for Form 943-X and correct previously filed 943 returns accurately.

Frequently Asked Questions

1. What is Form 943?

2. Who must file Form 943?

- Paid an employee $150 or more in cash wages during the year for agricultural work, or

- Paid a total of $2,500 or more in wages to all agricultural employees during the year.

3. When is the deadline to file Form 943 for 2025?

4. How does Form 943 differ from Form 941?

5. Can employers correct errors on Form 943?

6. What is Form 943-A?

7. How can I avoid penalties and interest on my tax filings?

- Ensure taxes are deposited or paid on time.

- File a fully completed Form 943 by the due date.

- Accurately report tax liabilities.

- Use valid checks for tax payments.

- Provide employees with accurate Forms W-2.