E-File Your Form 945-X for Tax Year 2025

Amend Your Withheld Federal Income Tax from non-payroll payments reported on Form 945 easily.

TaxZerone's secure e-filing platform ensures form submissions are accurate and comply with IRS.

File Form 945-X online to IRS at most affordable price

TaxZerone makes it simple to correct errors using our easy-to-use e-filing platform

$6.99

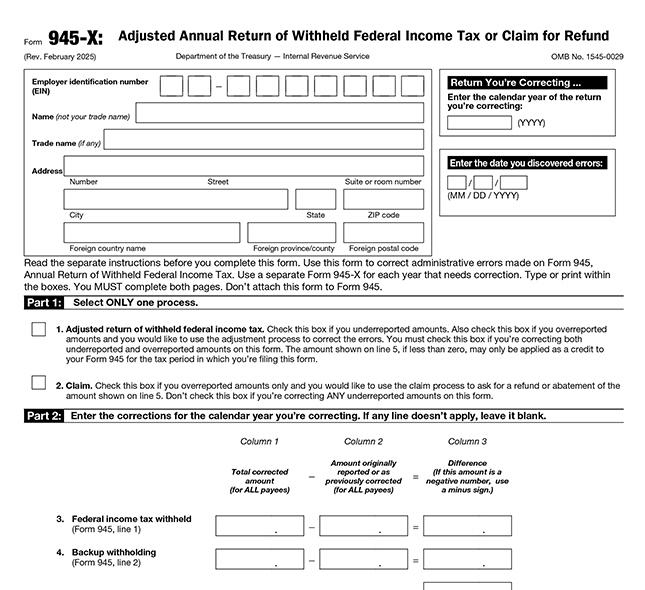

What is Form 945-X?

Form 945-X is to correct the withheld income tax amount from payees reported on previously filed Form 945, Annual Return of Withheld Federal Income Tax. The overreported taxes are entitled for refund or tax credit and the underreported taxes should be paid to the IRS.

Why file form 945-X?

Correct the errors

The error in the previously filed 945 forms should be corrected using

Form 945-X

Claim overreported tax

Adjust the overreported tax amount and claim as credits or refund.

Stay compliant with IRS

Correct the administrative errors by filing form 945-X to stay compliant with IRS.

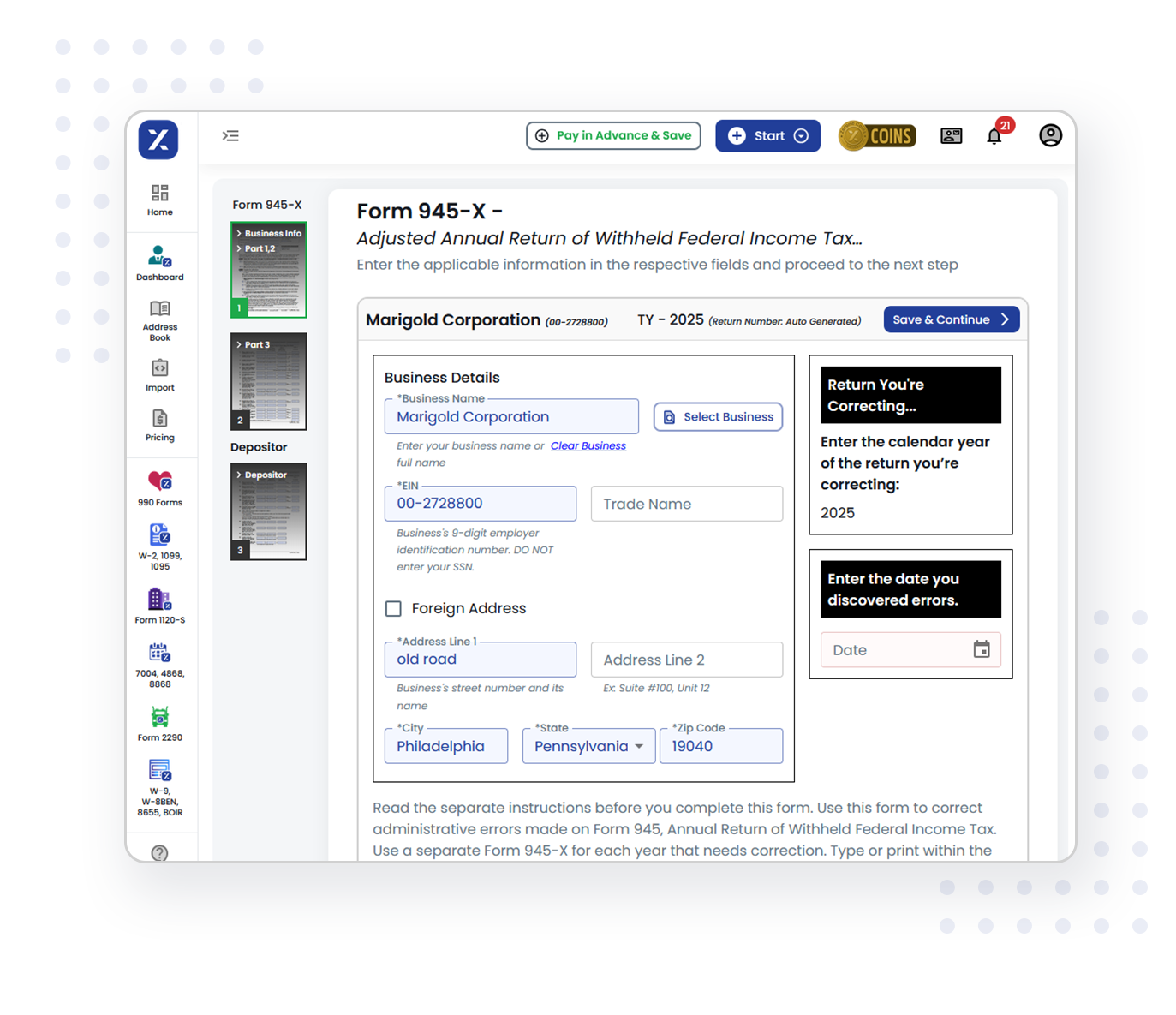

File Your Form 945-X in just 3 steps

Follow these steps to file Form 945-X easily and accurately

Step1: Enter the required details

Enter the Filer details and details of the correction required in previously filed IRS form 945

Step 2: Review the form 945-X

Review the provided information carefully and ensure the errors have been corrected

Step 3: Submit it to IRS

Submit Form 945-X with our user-friendly platform

Choose TaxZerone for Filing Form 945-X

IRS Authorized

TaxZerone is an IRS authorized E-file service provider, ensuring Form 945-X are filed accurately and are complying with IRS tax regulations.

Easy Filing

TaxZerone made filing easier, simpler, Securer and faster. Our platform helps to file Form 945-X in less than a minute.

Smart Validations

Our smart validation system detects the error in filing during submission. It helps you to save the time and reduce the risk of rejections.

Affordable Price

File your Form 945-X online to IRS at the most affordable price in the industry without compromising the quality of service.

Instant Notifications

Get real-time updates about the filing status after transmitting the return to the IRS.

Friendly Support

Our dedicated support team is there to assist with filing or any other issues.

What are the details required to file Form 945-X?

- Employer Details :

- - Business Name

- - Employer Identification Number (EIN)

- - Business Address

- - Calendar year of the return you are correcting

- - Date when the error was discovered

- Form 945-X information :

- - Total corrected federal income tax or back upwithholding tax

- - Detailed explanation of your corrections