E-File Your Form 941-X for Tax Year 2025

Amend Your Quarterly Employment Tax Returns Quickly and Accurately.

Ensure your employment tax returns are accurate and compliant with our user-friendly platform.

File Form 941-X online with the IRS at the lowest price.

An affordable flat price that ensures you get the most value without breaking the bank. No complex pricing structures and surprise charges—with us, what you see is what you get!

$6.99

Transparent pricing with no hidden fees

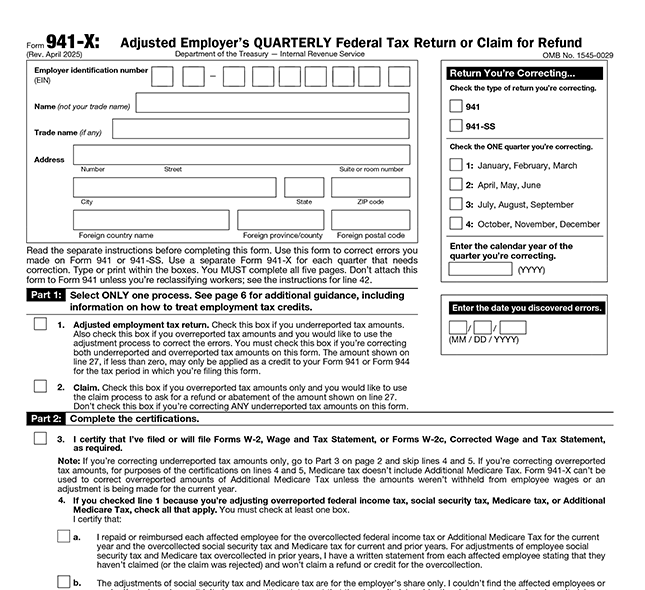

What is IRS Form 941-X?

Form 941-X is used to correct errors on previously filed Form 941, the Employer’s Quarterly Federal Tax Return. Whether you need to fix mistakes related to reported wages, tips, other compensation, federal income tax withheld, as well as social security and Medicare taxes, TaxZerone makes it easy to amend your returns accurately and promptly

Why File Form 941-X?

Correct Errors

Fix any mistakes made on your previously filed Form 941.

Avoid Penalties

Amend your returns promptly to avoid penalties and interest from the IRS.

Claim Refunds

Correct overreported taxes and claim refunds.

Fill out Form 941-X in just three easy steps

Follow these steps to confidently and accurately complete your filing.

Enter Your Information

Start by entering the details from your original Form 941 and the corrections needed.

Review and Validate

Review your entries and validate the corrections to ensure accuracy.

Submit to IRS

Submit your Form 941-X to the IRS directly through our secure platform.

Why Choose TaxZerone for Your Corrections?

See how TaxZerone makes filing Form 941-X easier for your business

IRS-Authorized

TaxZerone is an IRS-authorized e-file provider, ensuring your corrections are handled professionally.

Accurate Filing

Reduce the risk of errors with our comprehensive validation checks.

Secure and Reliable

Your data is protected with state-of-the-art security measures.

Instant Notification

Get real-time updates on your filing status with instant notifications for successful submissions and acceptance.

User-Friendly Interface

Our platform is designed for ease of use, guiding you step-by-step through the correction process.

Fast Processing

Submit your corrections quickly with our efficient system.

Form 941-X Filing Deadlines for Tax Year 2025

Ensure you file your Form 941-X corrections within the following deadlines based on the quarter in which the error was discovered:

| The Error Discovery Period for Tax Year 2025 | Form 941-X Due date |

|---|---|

| Jan, Feb, Mar | April 30, 2025 |

| Apr, May, June | July 31, 2025 |

| July, Aug, Sept | October 31, 2025 |

| Oct, Nov, Dec | January 31, 2026 |

Frequently Asked Questions

1. When should I file Form 941-X?

You should file Form 941-X as soon as you discover an error on your original Form 941. Prompt filing helps prevent penalties and interest for incorrect reporting.

The deadlines for filing corrections for each quarter are as follows:

- For errors in January, February, and March: File by April 30, 2025.

- For errors in April, May, and June: File by July 31, 2025.

- For errors in July, August, and September: File by October 31, 2025.

- For errors in October, November, and December: File by January 31, 2026.

Addressing errors quickly ensures that your tax records are updated and accurate, avoiding potential issues with your tax compliance and preventing any additional costs.

2. How do I know if my Form 941-X was accepted?

3. What types of errors can be corrected with Form 941-X?

4. Can I e-file Form 941-X?

Yes, you can e-file Form 941-X. The IRS started accepting e-filing for Form 941-X from the second quarter of 2024.

TaxZerone helps you to file your Form 941-X electronically, making the process faster and more convenient.