Form 2290 - Suspended Vehicles

E-File with Ease | Simplify Your HVUT Filing

With TaxZerone, you can e-file Form 2290 for your suspended vehicles and receive your IRS-stamped Schedule 1 copy within minutes.

Just $19.99 per return

What is a Suspended Vehicle?

A suspended vehicle is a heavy vehicle that doesn’t meet the mileage threshold set by the IRS, meaning you’re exempt from paying the Heavy Vehicle Use Tax (HVUT). Generally, vehicles that travel fewer than 5,000 miles (7,500 miles for agricultural vehicles) during the tax period are considered suspended and are not required to pay the HVUT.

However, owners of suspended vehicles still need to file Form 2290 to inform the IRS of their exempt status.

Who Qualifies for a Suspended Vehicle Exemption?

Own a heavy vehicle that rarely hits the road? You might qualify for a Heavy Vehicle Use Tax (HVUT) exemption!

Here's who qualifies:

- Vehicle Weight: Your vehicle weighs over 55,000 pounds.

- Mileage Limit: You've driven less than 5,000 miles (or 7,500 miles for agricultural vehicles) in the tax year.

If your vehicle meets these criteria, you don’t owe any HVUT. However, you still need to file Form 2290 with the IRS to claim your exemption (Category W).

Save time! File your Form 2290 with TaxZerone and keep your tax filing smooth and easy.

Get Schedule 1 copy in minutes

TaxZerone: The Smart Choice for E-filing Form 2290

Here’s Why:

Instant & Reliable E-Filing

TaxZerone provides fast and accurate e-filing for immediate and reliable IRS processing.

IRS-Authorized

TaxZerone is an IRS-authorized e-file service provider.

E-file Form 2290

Skip the hassle of paper forms - file electronically for faster processing.

Stay compliant

Ensure the IRS knows your vehicle is exempt and avoid potential penalties.

Accurate & Secure

We ensure your information is safe and your filing is error-free.

Choose TaxZerone for a hassle-free, accurate, and secure e-filing experience.

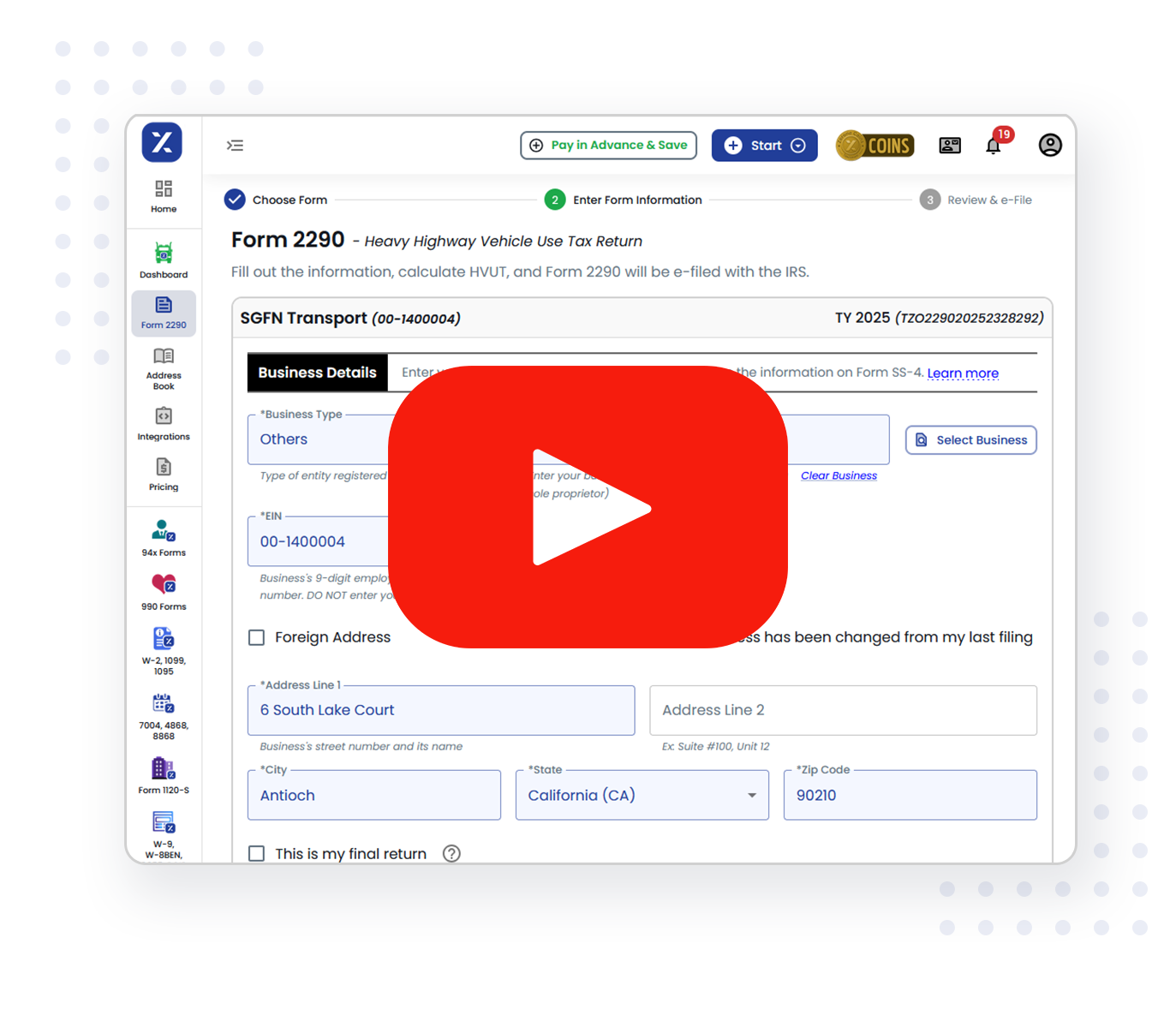

Get Your Schedule 1 TodayGet your IRS-Stamped Schedule 1 in 3 Simple Steps

TaxZerone simplifies Form 2290 e-filing for suspended vehicles, so you can get back on the road quickly.

Enter Form information

Provide the required information, such as name, EIN, VIN, taxable gross weight, and first used month (FUM).

Review the Tax Return

Check the information provided for accuracy and make any necessary edits.

Transmit & Get Schedule 1

Send your return to the IRS and receive your stamped Schedule 1 as soon as the IRS processes your return.

Get Your Schedule 1 Copy Today!

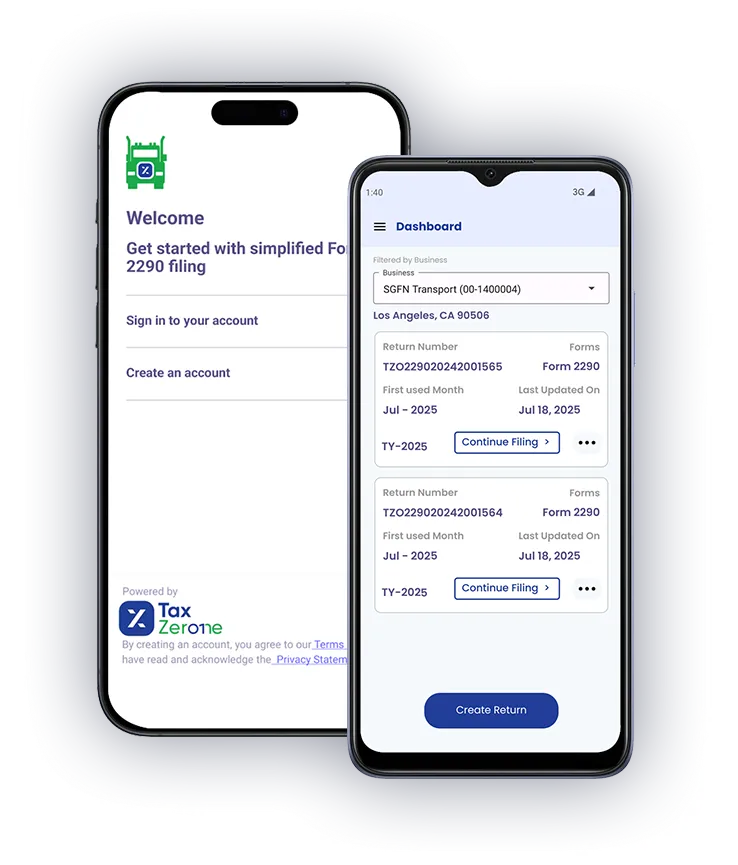

E-File Form 2290 on the Go…

Mobile Apps Tailored for Truckers to E-File Form 2290 Effortlessly.

Key Features:

- Secure E-Filing: Safely e-file Form 2290 for your suspended vehicles.

- Easy Access: Access your filed Form 2290 and Schedule 1 anytime, anywhere.

- Instant Confirmation: Receive immediate confirmation and updates on your filing status.

- User-Friendly Dashboard: Manage multiple vehicles and businesses with ease.

Install our app today and experience the ultimate convenience of e-filing Form 2290, right from your mobile device!

Save Time and Money with TaxZerone

Claim Your Tax Exemption for Suspended Vehicles By E-Filing Form 2290 with the IRS.

Fast & Accurate E-Filing

Experience quick and precise IRS submissions with TaxZerone's efficient e-filing service.

IRS-Authorized Service

Trust our secure platform to handle your tax exemption filing.

Instant Schedule 1

Receive your IRS-stamped Schedule 1 copy in minutes.

Get Schedule 1 copy in minutes

Frequently Asked Questions

1. How long does it take to receive the Schedule 1 copy after e-filing?

With TaxZerone, you can receive your IRS-stamped Schedule 1 copy in just minutes after the IRS processes your Form 2290.