Simplify Your 2025 Tax Season with Click2File

It take less than few minutes to complete your Tax Filing

Tax season just got a whole lot simpler with Click2File!

Say goodbye to the hassle of manually entering

your tax information

Automatically transfers relevant data from your previous year to your current one, saving you time and reducing errors.

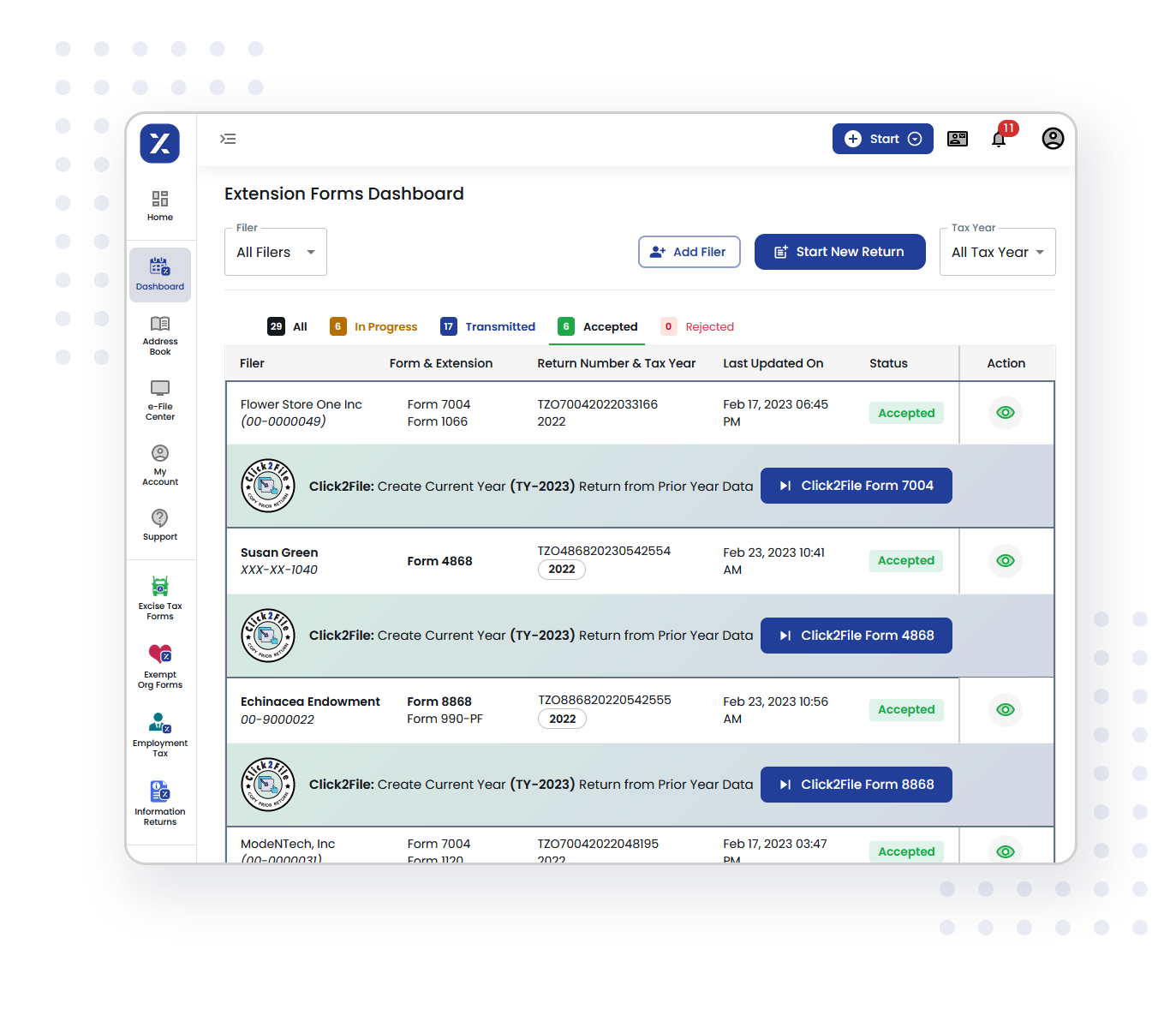

How Click2File Works

Click2File takes the hassle out of tax preparation by automatically transferring relevant data from your previous return to your current one.

Login and Select

Access your TaxZerone account and choose Click2File Form 7004, Form 4868, Form 8868, or 990 Ez.

Review and Customize

Click2File instantly populates your current return with essential details. Review and adjust anything to accurately reflect your current financial situation.

File with Ease

Once everything looks perfect, submit your return electronically. Click2File streamlines the filing process, making it a breeze!

Why Choose Click2File?

Efficiency

Save time by eliminating manual data entry.

Accuracy

Reduce errors with automatic population of relevant details.

Convenience

File your taxes from the comfort of your own home.

Peace of Mind

Rest assured knowing your return is accurately completed.

Stop stressing over tax preparation and start simplifying your filing process with Click2File

Join thousands of satisfied users who trust TaxZerone for their tax needs.

Simple. Secure. Accurate.

Frequently Asked Questions

1. What is Click2File and how does it work?

2. Does Click2File provide any guidance or support for filing my business tax return?

TaxZerone typically offers resources like FAQs, Field level help, Blogs and Support Site to answer common questions and guide you through the Click2File process. You may also have email, chat or phone support options for more specific assistance.

3. Can I edit or modify the pre-populated information in Click2File?

4. What are the benefits of using Click2File compared to manually filing my business tax return?

Click2File offers several advantages:

- Saves time and effort: Pre-populated data reduces manual entry, streamlining the filing process.

- Improves accuracy: Carryover of consistent data from the previous year minimizes errors.

- Simplifies tax season: Makes filing smoother and less stressful, especially for returns with minimal changes.