Fax the Reporting Agent Authorization Form to the IRS

Authorizing a Reporting Agent to file your tax forms?

Complete Form 8655 to authorize a reporting agent to file and deposit your employment taxes.

File at just $9.99 per Authorization form

Fax your Authorization of Reporting Agent affordably

Who needs to file Form 8655?

Businesses that are required to file federal employment tax forms, such as Forms 940, 941, 943, 944, 945, 1042, and CT-1 or make tax payments or deposits for Forms 1041, 1120, 720, 990-PF, and 990-T, may authorize a Reporting Agent to act on their behalf.

A Reporting Agent may be authorized to:

- File employment tax returns

- Make federal tax deposits and payments

To provide this authorization, the business must submit IRS Form 8655, Reporting Agent Authorization. This form allows the designated agent to perform specified tax-related duties for the business, as approved by the IRS.

Send the 8655 forms to the IRS in three simple Steps

Follow the easy steps to send Authorization of Reporting Agent

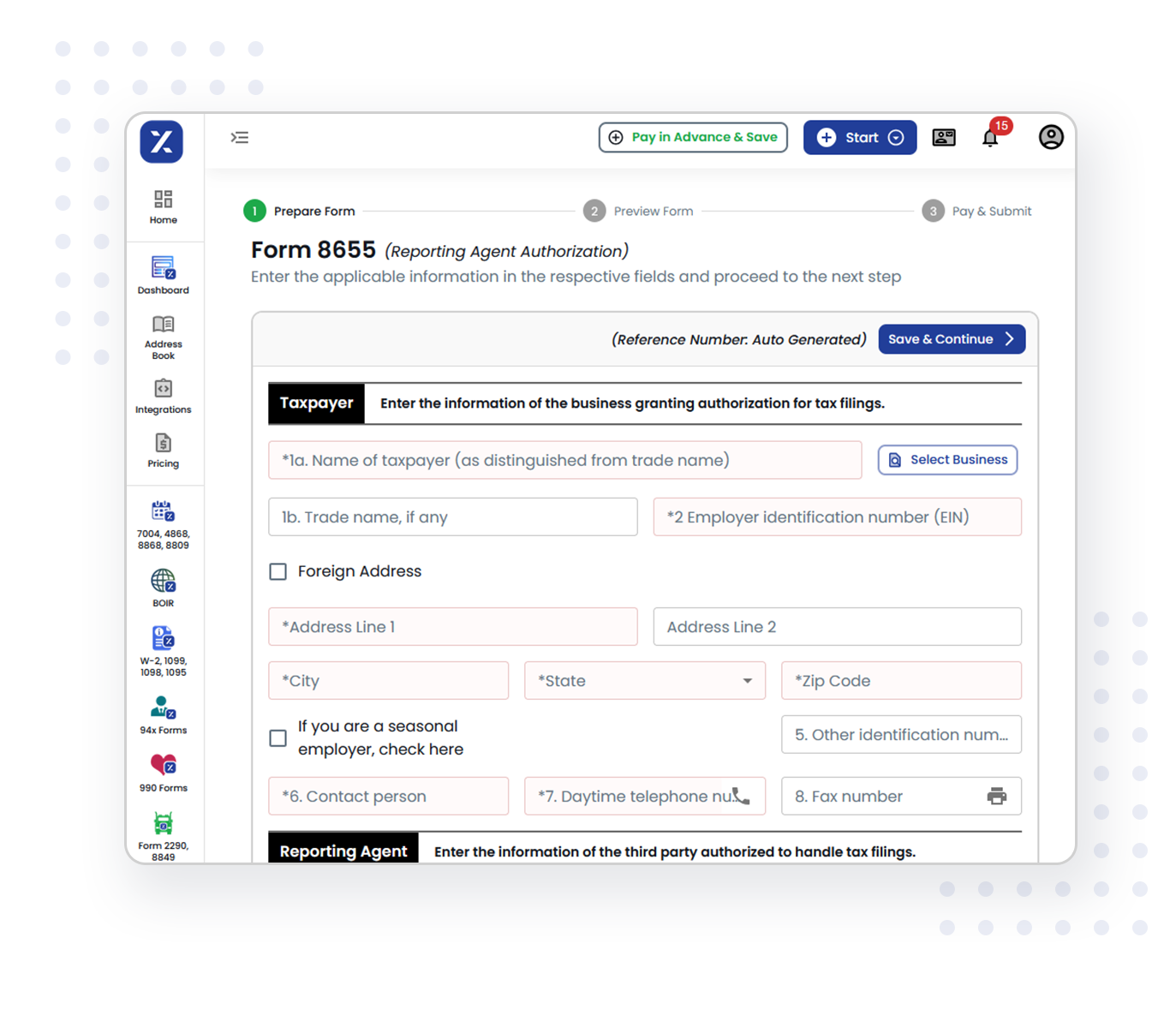

Enter Business and Reporting Agent Information

Provide the details of both the business granting authorization and the reporting agent.

Enter the year or month and year against the applicable form type

Select the forms you wish to authorize the Reporting Agent to file and to make payments or deposits on your behalf.

Review and submit the form

Review all entries on Form 8655 for accuracy. Make any necessary corrections. Submit the completed form to the IRS.

Authorize your reporting agent in just few clicks

Submit NowTaxZerone your reliable 8655 IRS Form filing platform

Our leading industry feature will make your filing simple, Secure and Affordable

Simple Filing

TaxZerone simplifies the process of filing IRS Form 8655. Experience the user-friendly platform designed to make authorization quick and easy.

Error free filing

TaxZerone ensures that Form 8655 is sent to the IRS error-free, as we validate all your filings against IRS rules and regulations.

On screen Guidance

Feeling stuck while filing? Simply click the info icon next to any field for a detailed explanation and guidance.

Secure

TaxZerone offers a secure tax filing solution. Your sensitive data is protected with industry-standard security measures.

Fax your form

Complete your authorization form and send it to the IRS quickly and easily via fax with just a few clicks through TaxZerone.

Instant Updates

You never have to be worried about missing any update or news about your filing. All updates from the IRS will be in your Inbox.

Affordable

File your authorization form without overspending. TaxZerone provides an affordable and reliable way to submit your IRS Form 8655

Customer Support

Our team of experts is here to assist you throughout your authorization form filing process. We are available to help through phone, live chat, or email

Paper filing

Need to Paper File Your Authorization Form? No worries, TaxZerone has you covered. You can now send paper copies of your Form 8655 to the IRS directly through TaxZerone

Choose TaxZerone for Simple, Secure and Affordable Authorization form 8655 filing

File Form 8655Excited to Try TaxZerone’s Features?

Easily fax your Authorization Form 8655 to the IRS through TaxZerone and authorize your Reporting Agent in just a few steps.

Frequently Asked Questions

1. What is form 8655?

Faxing Form 8655 to the IRS authorizes the Reporting Agent on the form to sign and file returns and make tax payments on behalf of the business. This authorization allows the Reporting Agent to file Forms 940, 941, 943, 944, 945, 1042, and CT-1. Additionally, the form can be used to authorize the agent to make tax payments for Forms 1041, 1120, 720, 990-PF, and 990-T along with previously mentioned forms. Once processed by the IRS, the Reporting Agent is permitted to act on the business’s behalf for the selected forms and services.

2. Who can authorize the reporting agent using 8655 forms?

The individual authorized to sign Form 8655 as business depends on the type of business entity. For a sole proprietorship or a single-member LLC, the business owner must sign. In the case of a partnership, any partner may sign. For an estate or trust, the fiduciary is the authorized signer. For a corporation, an individual authorized by the board of directors must sign the form.

3. How to file IRS form 8655?

Form 8655 can be submitted to the IRS either by faxing the completed form or by mailing a physical copy to the appropriate IRS address.

4. Where to fax 8655 forms?

5. Where to send form 8655?

Mailing Address:

Internal Revenue Service

Accounts Management Service Center

MS 6748 RAF Team

1973 North Rulon White Blvd.

Ogden, UT 84404