E-file Form 1098-C for Tax Year 2025

Report contributions of motor vehicles, boats, and airplanes effortlessly with TaxZerone’s IRS-authorized e-file service. Complete the process in just a few simple steps!

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

What is form 1098-C ?

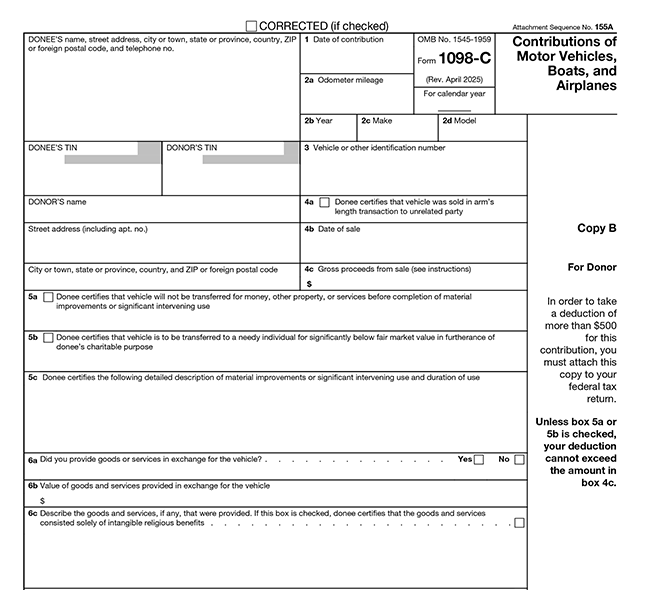

Form 1098 C is an IRS tax document that charitable organizations use to report vehicle donations (Motor Vehicles, boats, airplanes) valued over $500 . It provides essential information about the donated vehicle, including its make, model, year, and the charity's intended use, which helps donors claim potential tax deductions and ensures proper reporting to the IRS.

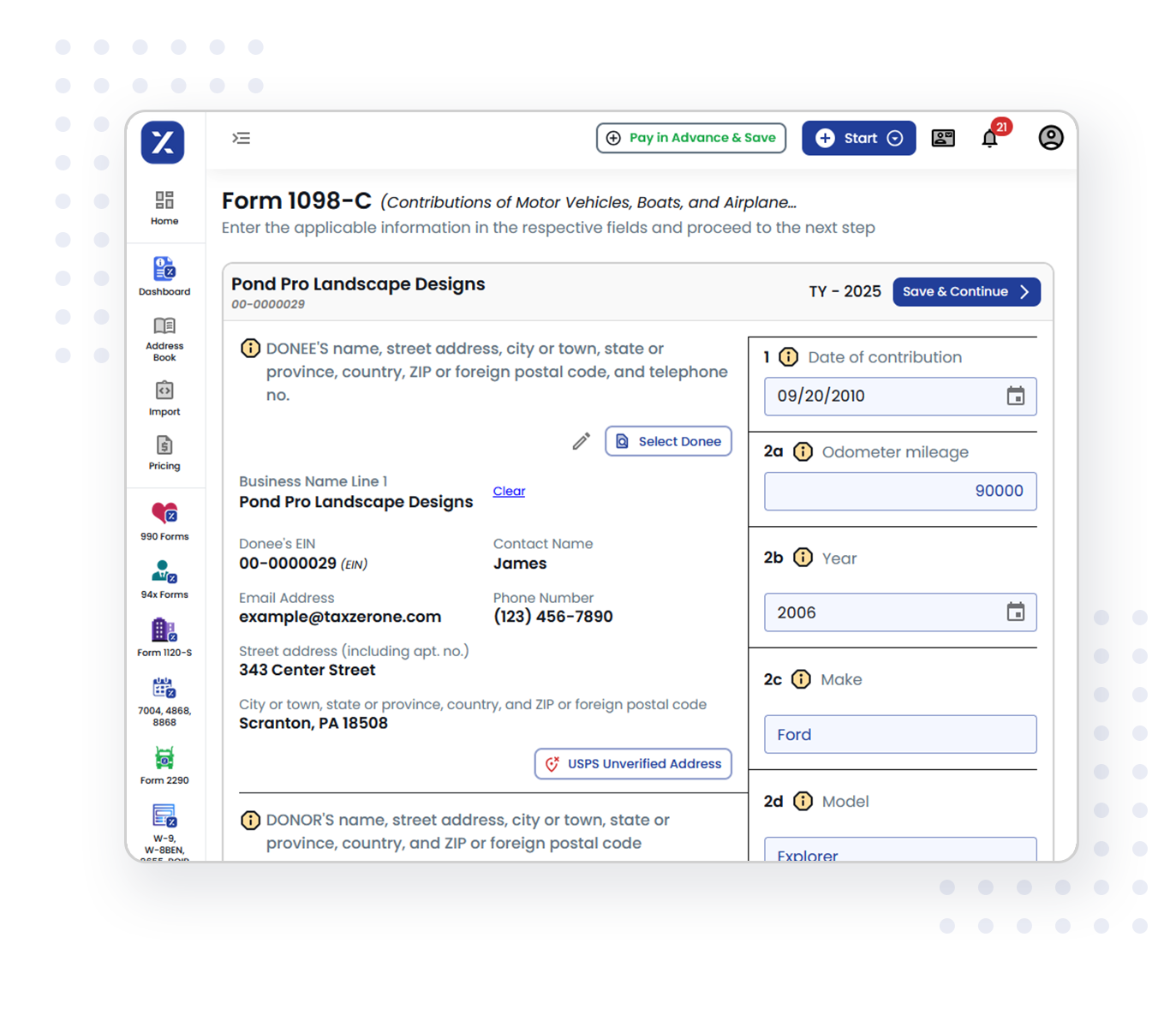

TaxZerone’s 3-Step Process for Completing Form 1098-C

Follow these 3 easy steps to quickly file your form online.

Enter Filer & Donor Details

Provide the DONEE’s name, address, telephone number, and the DONOR’s name, TIN, and address.

Report Donation Details

Enter the donation details, including the date, vehicle's fair market value, and other required information. If the vehicle is sold, report the sale price accurately

Review & Transmit

Review your return for accuracy, transmit it to the IRS, and deliver the recipient’s copy via ZeroneVault or postal mail

Required Information for E-Filing Form 1098-C

To e-file Form 1098-C (Contributions of Motor Vehicles, Boats, and Airplanes) with the IRS,

you need to include the following information:

- Donee’s Information: Full Name, Complete address, telephone no and TIN.

- Donor Information: Full Name, TIN, full address.

- Vehicle Information:

- Date of Contribution ( When the donor donated the vehicle)

- Odometer mileage, Year, Make, Model, VIN.

- Sale Information (if applicable):

- Date of sale.

- Gross proceeds from the sale

- Other Information:

- Value and description of any goods/services provided to the donor.

E-file your IRS Form 1098-C with TaxZerone for a secure, accurate, and hassle-free filing experience!

Why Should You E-File Form 1098-C with TaxZerone?

TaxZerone simplifies the online filing process with its top-notch features.

IRS form validations

TaxZerone performs automatic IRS form validations to ensure your

1098-C submissions are accurate and compliant. Our system checks for errors or missing information, reducing the risk of rejections and penalties from the IRS.

Easy Bulk Filing

Our bulk upload feature lets you file multiple forms at once, saving you time and effort. Whether it's just a few or a large number of submissions, TaxZerone simplifies the entire process.

Quick Recipient Copy Delivery

Share recipient copies instantly through ZeroneVault for secure digital access or choose traditional postal mailing.

Affordable Pricing

Enjoy industry-best pricing designed for your filing needs. Whether submitting a single form or managing high-volume filings, TaxZerone offers cost-effective solutions without compromising quality.

Re-Transmit Rejected Forms for Free

Fix errors and resubmit rejected forms at no extra cost with TaxZerone! Quick, easy, and hassle-free re-transmission.

Expert Assistance

Get expert help whenever you need it! Our team is ready to guide you through every step and answer your questions. Get the support you deserve with just a click!

Form 1098-C filing deadline for the 2025 Tax Year

Send Recipient Copies

Within 30 days of the Sale or Contribution Date

File with the IRS (e-file)

Deadline: March 31, 2026

File with the IRS (paper)

Deadline: March 2, 2026

Ready to file IRS Tax Form 1098-C? File quickly and easily with TaxZerone today!

Get Started NowMore Time Required to File? Request an Extension

Request additional time below to complete filing or send recipient statements.

Form 8809

Request an Extension to File Information Returns

- Need extra time to file your 1098 c forms? E-file Form 8809 to request an automatic 30-day extension to submit your form to the IRS.

Form 15397

Request an Extension to File Information Returns

- Need extra time to provide recipient copies of 1098 c forms? File Form 15397 to request a one-time 30-day extension to furnish recipient statements.

File Extension in Mins

Get Started with TaxZerone Today

TaxZerone makes tax filing quick, easy, and affordable with the best pricing in the industry.

- Ensure accuracy with built-in IRS compliance checks.

- Meet IRS reporting requirements with ease.

- Save time by filing multiple forms in one go.

- Enjoy the most competitive pricing in the industry.

Start e-filing now and complete Form 1098-C in just 3 simple steps!

Frequently Asked Questions

1. Who must file Form 1098-C?

A donee organization must file Form 1098-C for each qualified vehicle contribution with a claimed value over $500. This includes any motor vehicle manufactured primarily for public roads, boats, or airplanes. Vehicle dealers' inventory is excluded. Tax-exempt organizations must report these donations to both the IRS and the donor.

2. What types of donations require Form 1098-C?

Form 1098-C is required when a donor contributes a motor vehicle, boat, or airplane with a fair market value exceeding $500. The charity must report the vehicle's details, including whether it will be sold or used for charitable purposes. If the charity sells the vehicle, the donor's tax deduction is generally limited to the sale price.

3. When is Form 1098-C due?

- Recipient Copy: Must be sent within 30 days of the sale or contribution date.

- Paper Filing with the IRS: March 2, 2026

- E-filing with the IRS: March 31, 2026

4. What happens if I don't file Form 1098-C correctly?

- For vehicles sold (box 4a): penalty is larger of gross proceeds or sales price × 39.6%

- For vehicles kept (box 5a/5b): penalty is larger of $5,000 or claimed value × 39.6%