Form 1098-E Filing for Educational Institutions

Ensure your educational institution meets IRS requirements with fast, accurate, and compliant Form 1098-E filing.

Affordable Pricing

Start at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

Filing Requirements for Form 1098-E

Let's make your 1098-E filing a breeze! Here’s what you'll need:

- Lender Information: Lender’s Name, TIN, and Address

- Borrower Information: Borrower’s Name, TIN, and Address

- Payment Information: Total student loan interest received during the tax year

3 Simple Steps to E-file Your Form 1098-E

Filing your Form 1098-E with TaxZerone is fast, easy, and secure.

Here’s how you can do it in just three simple steps:

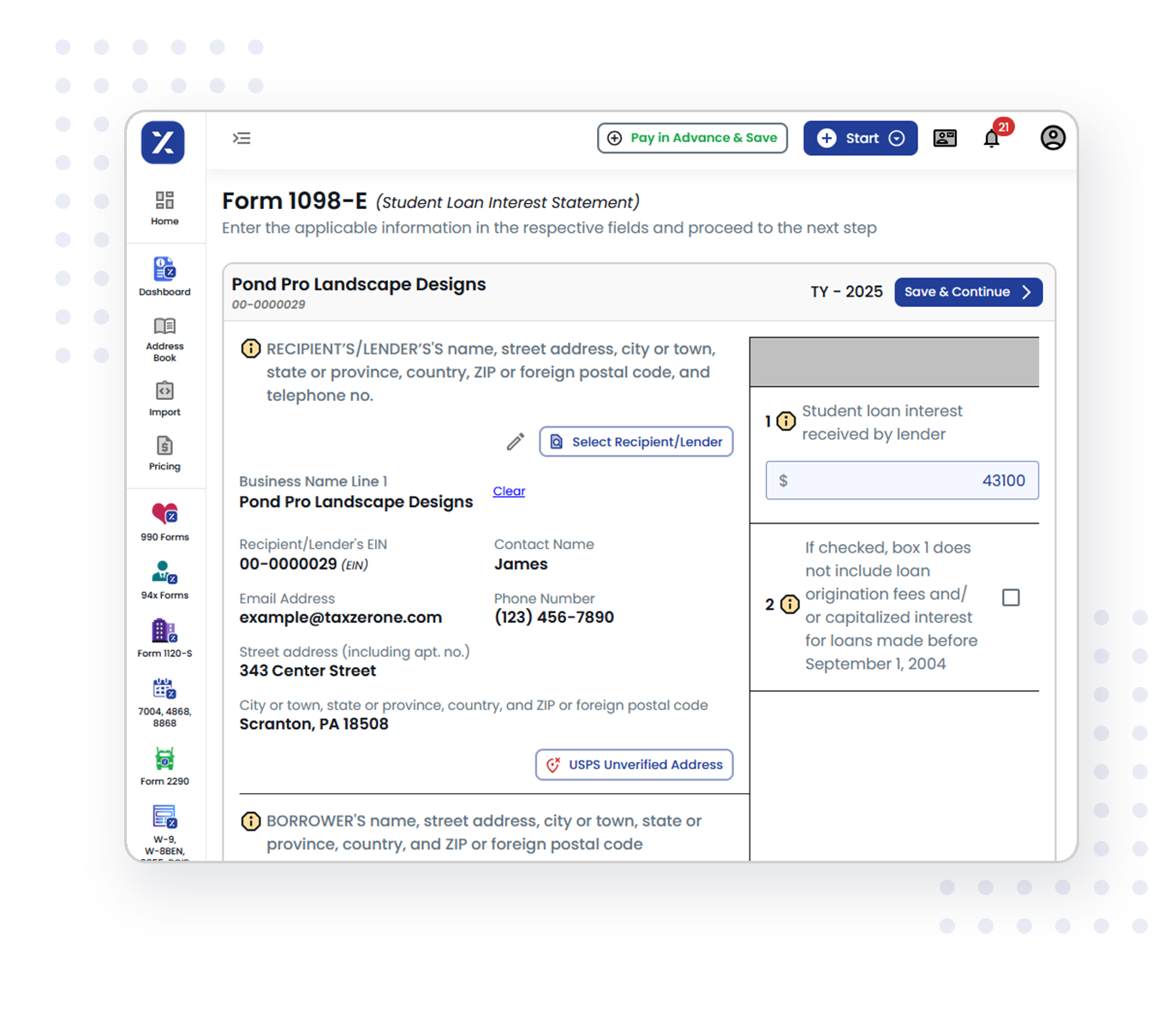

Enter Information for Form 1098-E

Simply fill in your details(Name, TIN and Address), the borrower's information (name, address, TIN), and the total student loan interest received.

Review & Transmit

Ensure accuracy with TaxZerone’s IRS validations, then securely e-file your Form 1098-E to the IRS.

Send Copy to Borrower

Securely deliver the borrower's copy via ZeroneVault, ensuring safe sharing or opt for postal mail.

Why Choose TaxZerone to E-file 1098-E?

TaxZerone is the reliable e-filing solution trusted by businesses of all sizes. Here's why:

Accurate Form Validations

Minimize errors and ensure compliance with built-in form validations, reducing the risk of rejections.

Effortless Bulk Upload

Save time by uploading multiple 1098-E records at once, making large-volume filing faster.

Eco-Friendly Sharing of Borrower Copies

Securely distribute borrower copies through ZeroneVault to minimize paper waste, or opt for traditional postal mailing if preferred.

Best Pricing in the Industry

Get cost-effective pricing based on your filing volume.

User-Friendly Form-Based Filing

Our form-based interface simplifies the filing process and enhances usability.

Guided e-Filing Support

Clear instructions guide you step-by-step through the filing process.

Important Deadlines for Filing Form 1098-E

Borrower Copy Deadline

Deadline: February 2, 2026

Send Form 1098-E to your students by this date so they can use it to file their taxes.

IRS eFile Deadline:

Deadline: March 31, 2026

Submit your Form 1098-E filings electronically to the IRS by this date to avoid penalties.

IRS Paper Filing Deadline

Deadline: March 2, 2026

If you file paper copies with the IRS, submit them by this date to avoid penalties.

Save time and stay compliant with TaxZerone.

Start Your 1098-E Filing Today!More Time Required to File? Request an Extension

Request additional time below to complete filing or send recipient statements.

Form 8809

Request an Extension to File Information Returns

- Need extra time to file your 1098 e forms? E-file Form 8809 to request an automatic 30-day extension to submit your form to the IRS.

Form 15397

Request an Extension to File Information Returns

- Need extra time to provide recipient copies of 1098 e forms? File Form 15397 to request a one-time 30-day extension to furnish recipient statements.

File Extension in Mins

E-file Form 1098-E Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Schedule Filing: Plan Ahead and Stay On Track

Want to ensure your filings are submitted on time without the stress? With Schedule Filing, you can prepare your Form 1098-E filings in advance, and we’ll take care of the submission when the time comes.

Choose Your Filing Date

Set your preferred filing date, and we’ll ensure your forms are submitted to the IRS promptly and accurately.

Ensure Accuracy

Borrowers can review their 1098-E forms before submission, allowing them to identify and correct any errors in advance.

Avoid the Need for IRS Correction Forms

Scheduling your filing provides an opportunity to validate all details beforehand, reducing errors and eliminating the hassle of filing IRS correction forms later.

Share Borrower Copies with Ease

TaxZerone makes it simple to deliver Form 1098-E copies to your recipients securely and on time.Choose the method that suits your business needs:

Secure Delivery via ZeroneVault

- Share borrower copies electronically through ZeroneVault, a secure and user-friendly platform.

- Borrowers can access their forms instantly, without the hassle of printing or mailing.

- ZeroneVault ensures data security, providing peace of mind when sharing sensitive tax information.

Traditional Postal Mailing

- Prefer a physical copy? TaxZerone also offers postal mailing services.

- We’ll deliver borrower copies promptly, ensuring compliance with IRS deadlines.

- Save time and enjoy a hassle-free experience by letting TaxZerone handle the mailing process for you.

Get Started with TaxZerone Today

Filing Form 1098-E online has never been easier. With TaxZerone, you can:

- File quickly and accurately.

- Stay compliant with IRS deadlines.

- Save time and money with our industry-leading features.

Frequently Asked Questions

1. Who is required to file Form 1098-E?

Educational institutions and lenders are required to file Form 1098-E for individuals who paid interest on qualified student loans during the tax year. Specifically, if a student has paid $600 or more in interest on a student loan, the institution or lender must issue Form 1098-E. This helps students claim the student loan interest deduction when filing their taxes.

Who needs to file?

- Educational Institutions: Required to file for students who have paid interest on student loans.

- Lenders or Loan Servicers: Must report student loan interest payments if they meet the $600 threshold.

2. What is the deadline to send Form 1098-E to students?

Form 1098-E must be filed and distributed to recipients by specific deadlines. Adhering to these deadlines ensures that the students have the information they need to file their tax returns on time and helps avoid penalties for late filing.

- Borrower Copy Deadline (Student Copies):

- Must be provided to students by January 31* of the year following the tax year.

- IRS Paper Filing Deadline:

- If filing paper copies, the form must be submitted to the IRS by February 28*.

- IRS Electronic Filing Deadline:

- For electronic submissions, the form must be filed with the IRS by March 31.

Meeting these deadlines is critical for ensuring timely processing and compliance.

3. What happens if I miss the Form 1098-E filing deadline?

Penalties for Late Filing:

- $60 per form if filed within 30 days of the due date.

- $130 per form if filed more than 30 days late but by August 1.

- $340 per form if filed after August 1 or not filed at all.

Additional Notes:

- Penalties can double for intentional disregard of the filing requirement.

- Separate penalties apply if you fail to provide recipient copies to students on time.