E-file Form 1098-F for Tax Year 2025 with Ease

Report fines, penalties, and other amounts required by court orders or governmental agreements with TaxZerone’s secure and IRS-authorized e-file service. Complete the filing in just a few simple steps!

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

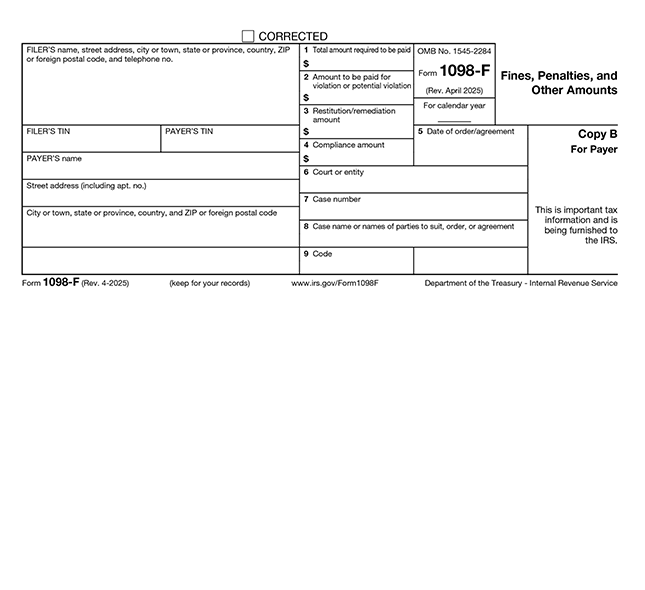

What is Form 1098-F?

Form 1098-F is used to report fines, penalties, and other amounts paid due to a legal settlement or court order. Government entities or those acting on their behalf file this form when the total payment exceeds $50,000. It helps track violations of law, investigation costs, and compliance-related payments.

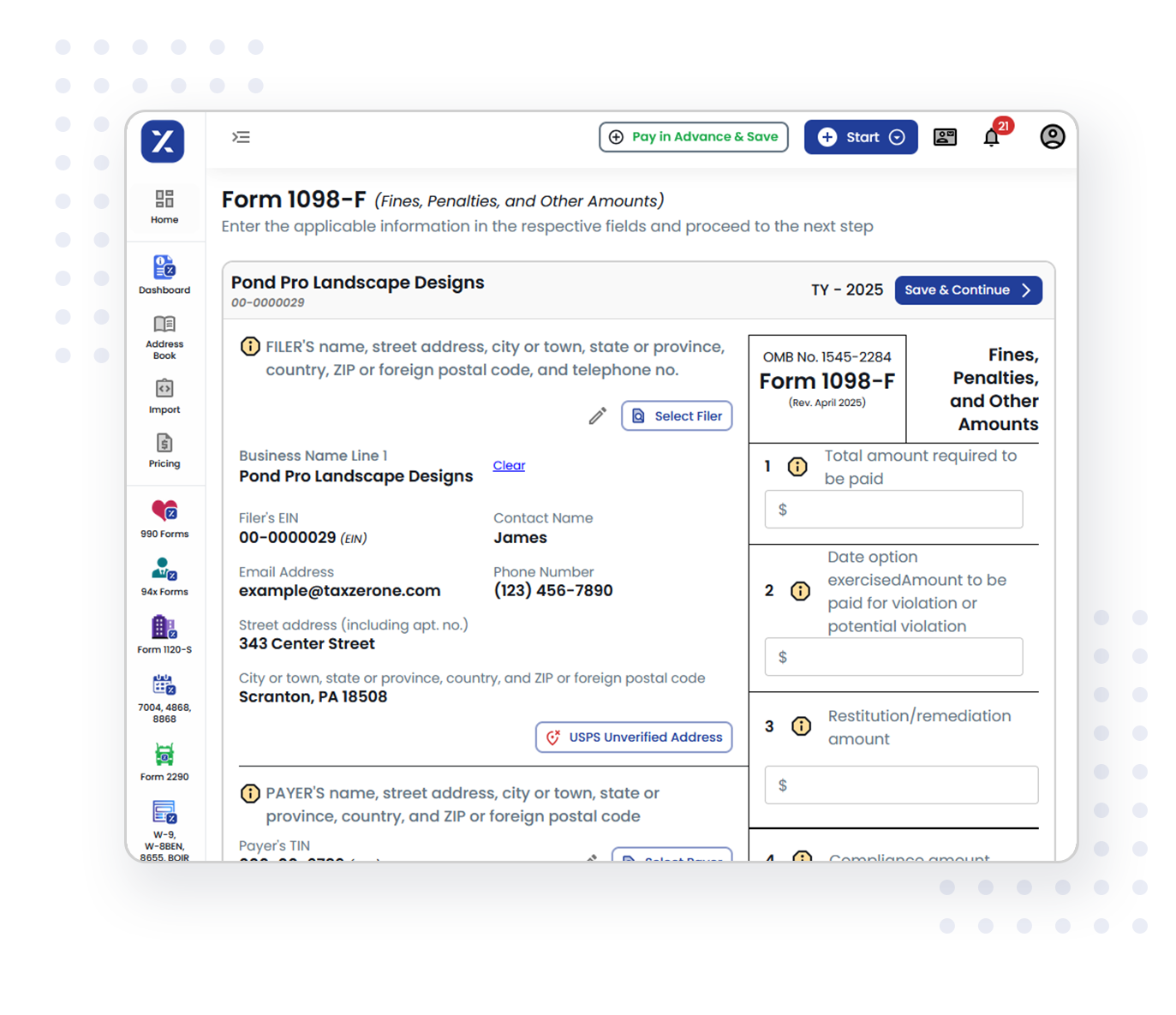

3 Simple Steps to E-file Your IRS Form 1098-F

Filing 1098-F electronically with TaxZerone is quick and simple:

Enter Filer & Payer Details

Provide the necessary filer and payer details such as name, TIN, and address in the designated fields.

Report Payment Information

Enter the total amount due, violation-related payments, restitution, compliance amounts, and agreement details.

Review & Transmit

Securely review your return for accuracy and transmit it to the IRS with ease.

Required Information for E-Filing Form 1098-F

To e-file Form 1098-F (Fines, Penalties, and Other Amounts) with the IRS, you need to include the following information:

- Filer’s Information: Name, complete address, and EIN of your entity.

- Payer’s Information: Name, complete address, and TIN (SSN for an individual; EIN for a business).

- Fine, Penalty, or Other Amount Details

- Total amount required to be paid

- Amount to be paid for violation or potential violation

- Restitution/remediation amount & Compliance amount

- Order or Agreement Information:

- Date of order/agreement

- Name of the court, or any other entity

- Case Information: Case number, Case name or names of parties & Applicable Code

Start your filing process now with TaxZerone and complete your 1098-F Form in minutes.

Why Choose TaxZerone for Form 1098-F E-Filing?

TaxZerone is the trusted e-filing solution for reporting governmental fines, penalties, and other required amounts. Here’s why we are the best choice for filing Form 1098-F:

IRS Form Validations

Our system automatically checks for errors, missing details, and formatting issues to ensure your Form submission is accurate and IRS-compliant. Reduce the risk of rejections and avoid penalties with our built-in validation tools.

Bulk Filing Made Easy

Need to report multiple fines or penalties? Our bulk upload feature allows you to file multiple Forms at once, saving time and effort. Whether handling a few filings or large-scale submissions, TaxZerone streamlines the process.

Instant Recipient Copy Delivery

Easily share recipient copies through ZeroneVault for secure digital access or opt for traditional postal mailing. No need for manual printing—send copies quickly and efficiently with just a few clicks.

Affordable Pricing for All Filers

Enjoy industry-best pricing tailored to your filing needs. Whether submitting a single form or managing high-volume filings, TaxZerone offers cost-effective solutions without compromising on quality.

User-Friendly Filing Process

Our simple form-based filing system ensures a hassle-free experience. Just enter the required details, and our platform takes care of the rest—no complex steps or confusing processes.

Step-by-Step Filing Assistance

Need help with a specific section? Our guided filing experience includes real-time prompts and expert support to help you complete your Form 1098-F filing with confidence.

Form 1098-F filing deadline for the 2025 Tax Year

Send Recipient Copies

Deadline: February 2, 2026

File with the IRS (e-file)

Deadline: March 31, 2026

File with the IRS (paper)

Deadline: March 2, 2026

TaxZerone recommends filing Form 1098-F online for faster processing, fewer errors, and a lower risk of IRS penalties. Timely and accurate filing helps you stay on track with IRS requirements.

File 1098-F Now!More Time Required to File? Request an Extension

Request additional time below to complete filing or send recipient statements.

Form 8809

Request an Extension to File Information Returns

- Need extra time to file your 1098 f forms? E-file Form 8809 to request an automatic 30-day extension to submit your form to the IRS.

Form 15397

Request an Extension to File Information Returns

- Need extra time to provide recipient copies of 1098 f forms? File Form 15397 to request a one-time 30-day extension to furnish recipient statements.

File Extension in Mins

Get Started with TaxZerone Today

Filing Form 1098-F online is quick and hassle-free with TaxZerone. You can:

- File accurately with built-in IRS compliance checks

- Stay compliant with IRS reporting requirements

- Save time by filing multiple forms at once.

- Benefit from the most affordable pricing in the industry.

Start your e-filing today and complete Form 1098-F in just 3 simple steps!

Frequently Asked Questions

1. Who must file Form 1098-F?

Government entities, including federal, state, local, and tribal authorities, must file Form 1098-F if they impose fines, penalties, or similar monetary assessments. This requirement ensures transparency in reporting financial penalties.

2. When is the filing deadline?

- Recipient Copies: Must be provided by February 2, 2026.

- Paper Filing with IRS: Due by March 2, 2026.

- Electronic Filing with IRS: Due by March 31, 2026.

Late filings: May result in IRS penalties, so it’s important to file on time.