Streamline your Form 1099 corrections for the 2025 tax year

Seamless and efficient way to correct any errors on your IRS Form 1099 filings with the IRS. TaxZerone can save you time and ensure that you are in compliance with the IRS.

Takes less than 5 minutes

Industry-leading pricing

Experience the best pricing in the industry, starting at just $2.49. Rates decrease to as low as $0.59 per form for larger quantities.

For your return volume

Make corrections to your Form 1099 in 3 simple steps

With TaxZerone, filing Form 1099 corrections is effortless

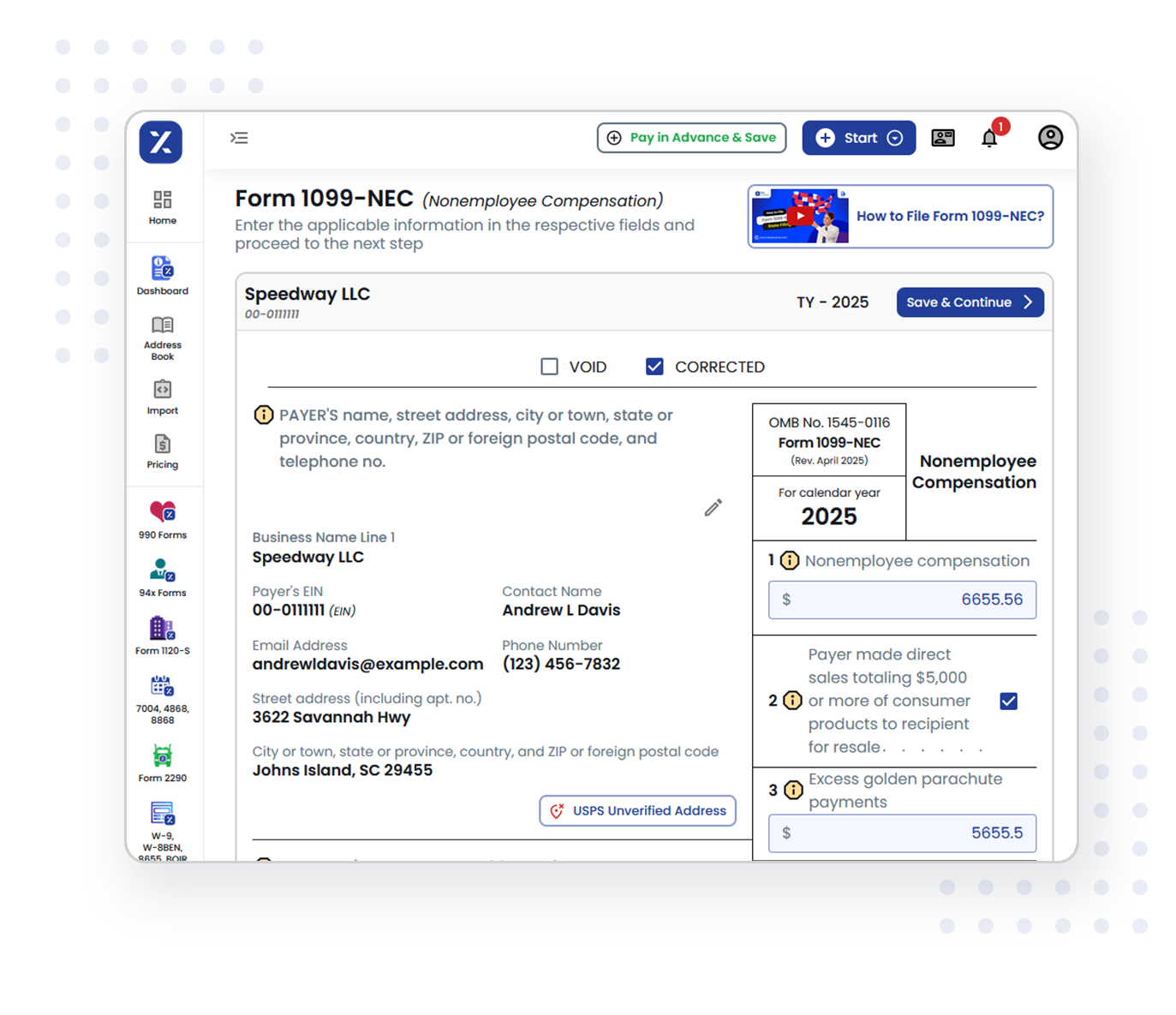

Choose the correction type

Select whether you want to file a correction form or void a previously filed form.

Provide the correct information

Enter the necessary corrections in the corresponding fields, such as payer, recipient, and amount information. Then, transmit the return to the IRS.

Send the recipient copy

Easily send corrected recipient copies via email for swift delivery.

Takes only 3 steps

Top reasons to choose TaxZerone for

Form 1099 correction e-filing

See how TaxZerone simplifies your correction filing

Smart IRS validations

Our real-time validation checks ensure compliance with IRS standards and minimize costly errors and rejections.

Supports bulk upload

Easily streamline your 1099 correction e-filing process by uploading multiple form entries with TaxZerone.

Email recipient copies

Save time and resources by effortlessly emailing recipient copies for prompt delivery.

Competitive pricing

Benefit from highly competitive rates tailored to your return volume and manage costs effectively.

Get Form 1096 for FREE

Get your updated Form 1096 generated at no extra charge. Access the form copy anytime for your records.

Quick correction filing

Correct your Form 1099s efficiently in just a few minutes with our user-friendly flow and step-by-step instructions.

Ready to e-file Form 1099 corrections?

Choose TaxZerone for a seamless and efficient Form 1099 correction filing experience

Takes 3 steps and less than 5 minutes

Frequently Asked Questions

1. When is the due date to file 1099 corrections?

2. What information can be corrected in Form 1099?

- Recipient information such as name, TIN, and address

- Amounts reported

- Name, address of payer, and tax year

- Error type

- Correct payer information

- Return type

- Filing method: paper filing or e-filing

- Federal income tax withheld