File IRS Form 1099-DA Online for the 2025 Tax Year

Report digital asset proceeds with IRS-authorized e-filing through TaxZerone. We make Form 1099-DA filing simple, whether you’re filing just one form or thousands.

Affordable Pricing

Start at just $2.49, with prices as low as $0.59 per form for bulk filings.

For your return volume

What is IRS Form 1099-DA?

Form 1099-DA (Digital Asset Proceeds) is the IRS information return used to report proceeds from digital-asset transactions (cryptocurrency, NFTs, qualifying stablecoins, tokenized assets, and similar digital representations of value) that brokers effect for customers. The form is intended to bring digital-asset reporting in line with other broker reporting regimes.

This form helps ensure taxpayers accurately report their digital asset gains and losses.

Typically, Form 1099-DA is issued when:

- A customer sells or exchanges cryptocurrency on a brokered platform.

- NFTs or tokens are traded or redeemed on a covered platform.

- Stablecoins are converted (as defined under the instructions) in reportable transactions.

- Any brokered transaction involving digital assets occurs.

Any brokered transaction involving digital assets occurs.

To complete your filing with TaxZerone, gather the following:

- Filer Information: Name, EIN, and Address

- Recipient Information: Name, TIN, and Address (TIN matching recommended).

- Transaction Details: Type of digital asset, date acquired (if available), date disposed, quantity/units, transaction identifier(s) where applicable.

- Financial details (2025 reporting): Gross proceeds from the sale/exchange are required for 2025 transactions. Cost basis and gain/loss information are not required for sales effected in 2025 (brokers may voluntarily report basis for 2025, but are not required to). Mandatory basis/gain reporting and related boxes apply more broadly for 2026 and later as described in IRS guidance.

You can also upload your filings in bulk using our pre-formatted Excel templates.

Who Must File Form 1099-DA?

You are required to file Form 1099-DA if you are a:

- Digital asset broker or exchange

- Hosted wallet provider

- Payment processor facilitating crypto payments

- Platform that enables trading or redemption of NFTs,

tokens, or stablecoins

3 Simple Steps to Complete Your Form 1099-DA E-filing

Filing your Form 1099-DA with TaxZerone is fast, easy, and secure. Here’s how you can do it in just three simple steps:

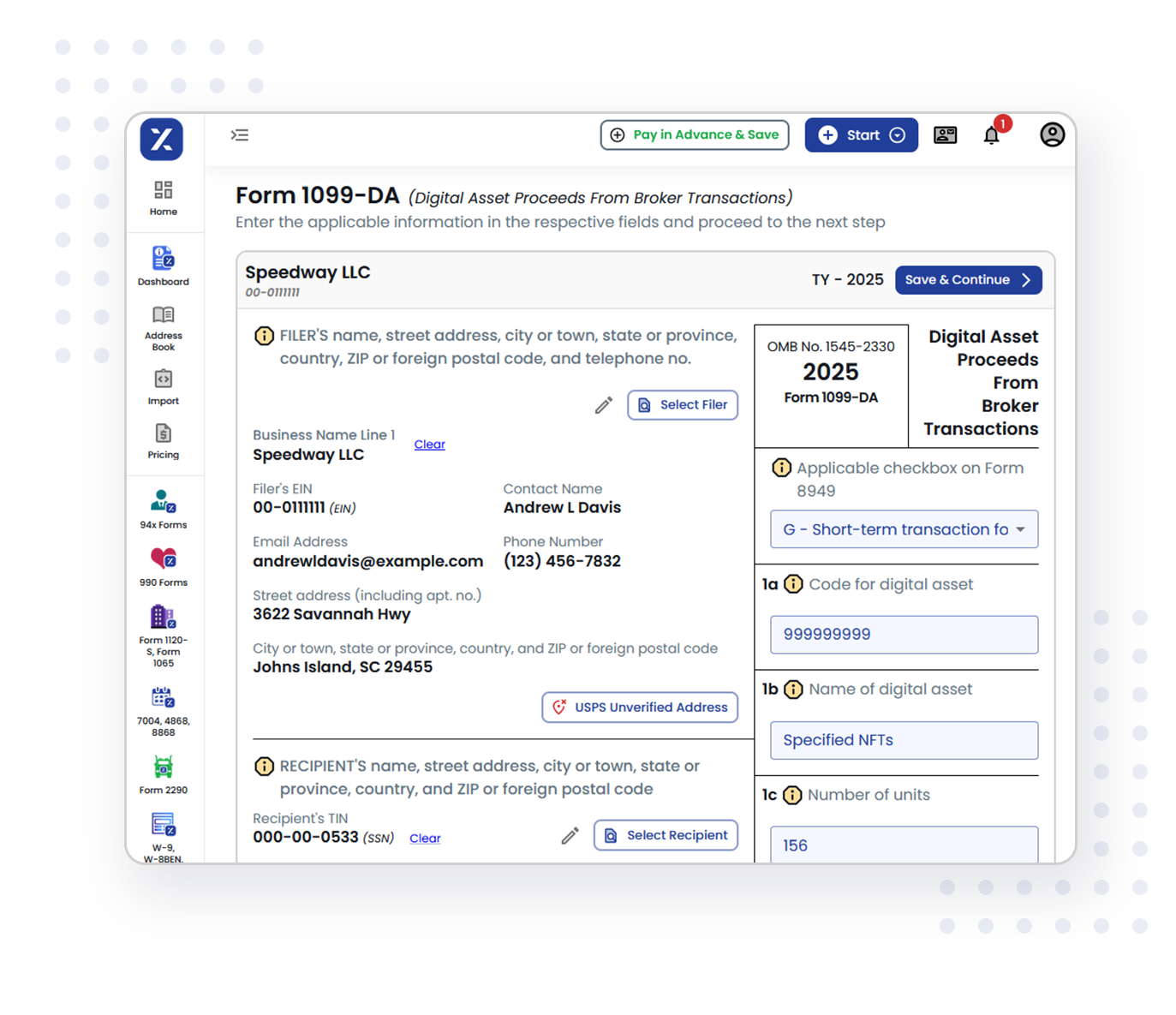

Enter Information:

Log in to TaxZerone, choose Form 1099-DA, and fill in broker, recipient, and transaction details using our guided interface.

Review & Submit:

Our platform validates your form for IRS compliance, helping prevent errors or rejections. Once reviewed,

e-file it directly with the IRS.

Share Borrower Copies:

After filing, send copies to customers via:

- ZeroneVault: Encrypted digital delivery

- Postal Mail: Printed and mailed copies

- Download: Secure PDF download from your account

Why Choose TaxZerone for Form 1099-DA E-filing?

Built-in IRS Checks

Our system automatically validates your Form 1099-DA entries before submission, helping prevent rejections and penalties by catching missing or incorrect details.

Share Recipient Copies

Once filed, quickly send recipient copies digitally via ZeroneVault or opt for postal delivery-no manual mailing required.

Fast Bulk Filing Option

Need to file dozens or hundreds of 1099-DA forms? Easily upload multiple records in one go and streamline your entire reporting process.

Best Price in the Industry

Enjoy affordable rates based on your filing volume. With TaxZerone, you save both time and money-without compromising on accuracy.

Step-by-Step Filing Interface

Our intuitive form-filing tool walks you through each step no technical skills or tax expertise needed.

Guided Filing

Access smart prompts and

expert-guided help during filing to ensure you get it right the first time.

Form 1099-DA Filing Deadlines – 2025 Tax Year

Provide recipient copy

Due Date: February 17, 2026

File with IRS (e-file)

Due Date: March 31, 2026

File with the IRS (paper)

Due Date: March 2, 2026

More Time Required to File? Request an Extension

If you need additional time to file or send recipient statements,

you can request an extension using the forms below.

Form 8809

Request an Extension to File Information Returns

- Need extra time to file your form 1099 da? E-file Form 8809 to request an automatic 30-day extension to submit your 1099s to the IRS.

Form 15397

Request an Extension to File Information Returns

- Need extra time to provide recipient copies of form 1099 da? File Form 15397 to request a one-time 30-day extension to furnish 1099 recipient statements.

File Extension in Mins

Penalties

Late, incorrect, or missing filings for information returns (including 1099-DA) can lead to the following penalties

per form (for tax year 2025 reports due in 2026):

| When filing is late or incorrect | Penalty per form |

|---|---|

| Within 30 days of due date | $60 |

| More than 30 days but by August 1 | $130 |

| After August 1, or not filed at all | $340 |

| If filer intentionally disregards filing requirements | $680 |

Penalties are adjusted annually for inflation and subject to maximums depending on business size.

E-file Form 1099-DA Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099 State Filing | Price Per Form |

|---|---|

| Per Form | $0.99 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Need to send recipient copies by mail? Add postal delivery at just $1.75 per form or electronic delivery via ZeroneVault at $0.50.

Common Use Cases

- Reporting crypto-to-fiat sales

- Recording NFT trades or redemptions

- Reporting stablecoin conversions

- Digital asset brokers reporting customer exchanges

Want to know if your situation requires a 1099-DA? Contact our support team -we’ll help you determine eligibility.

Pro Tip

Schedule Your 1099-DA Filing Early

Use our filing scheduler to select a future date for submission. This allows:

- Recipient review in advance

- Early error detection

- On-time delivery before deadlines

TaxZerone offers the perfect balance of compliance, convenience, and cost. Don’t settle for outdated or overpriced alternatives.

Why Not File Form 1099-DA Manually?

Filing on paper may seem simple—but it can cost you more timeand money in the long run due to delays and manual errors.

Common Drawbacks of Manual Filing:

- Time-consuming: Requires printing, addressing envelopes, and visiting the post office

- Higher error risk: No validations, leading to IRS rejections

- No tracking: You won’t know if the IRS or recipient received the form

- Delayed processing: Paper forms take longer to process than electronic submissions

- No audit protection: Manual errors may result in penalties or correction forms

Benefits of E-filing with TaxZerone:

- Instantly submit forms to the IRS

- Auto-checks for TIN mismatches and missing fields

- Schedule filing dates to stay ahead of deadlines

- Recipient copies sent via ZeroneVault or mail

- Access to support if you need help at any step

Ready to E-file IRS Form 1099-DA?

Avoid delays, rejections, and penalties-e-file your Form 1099-DA securely with TaxZerone in just minutes.