File Form 1099-G for Tax Year 2025 with Ease

Report government payments with TaxZerone’s accurate and hassle-free e-filing solution for Form 1099-G.

Affordable Pricing

Start at just $2.49, with prices as low as $0.59 per form for bulk filings.

For your return volume

Filing Requirements for Form 1099-G

Let’s make your 1099-G filing stress-free! Here's what you'll need:

- Payer Information: Payer’s Name, TIN, and Address

- Recipient Information: Recipient’s Name, TIN, and Address

- Payment Information: Unemployment Compensation, State or Local Income Tax Refunds, and Federal Tax Withheld (if applicable)

- State Tax Information: State Name, State Identification Number, and State Income Tax Withheld.

3 Simple Steps to Complete Your Form 1099-G E-filing

Filing your Form 1099-G with TaxZerone is fast, easy, and secure.

Here’s how you can do it in just three simple steps:

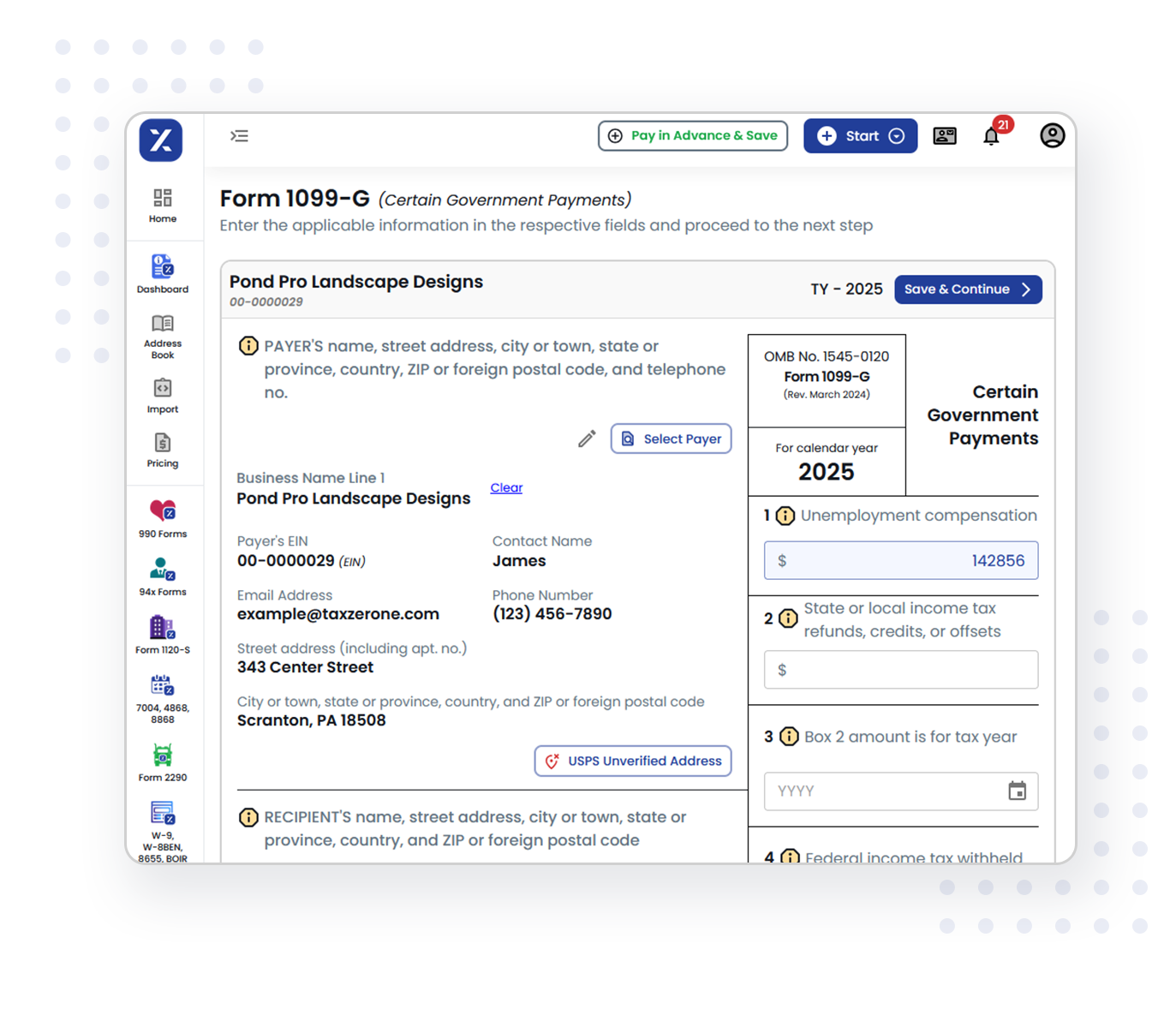

Enter Information for Form 1099-G

Fill in your business/ Individual details (EIN/SSN), recipient's information (name, address, TIN), and the payment information.

Review & transmit

Ensure accuracy with TaxZerone’s IRS validations, then securely e-file your Form 1099-G to the IRS.

Send Recipient Copy

Securely deliver the recipient's copy via ZeroneVault, ensuring safe sharing. Alternatively, choose postal mailing for a reliable hard copy delivery.

Why Choose TaxZerone for Form 1099-G E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here’s why:

IRS Form Validations

Automatic IRS form validations ensure your Form 1099-G submissions are accurate and compliant. Our system checks for errors or missing information, reducing the risk of rejections and penalties.

Supports Bulk Upload

TaxZerone offers a bulk upload option for filing multiple 1099-G forms at once, saving you time. Whether you have a few transactions or hundreds, we’ve got you covered.

Share Recipient Copies

After filing, easily share the recipient's copy via ZeroneVault or postal mail to ensure timely delivery.

Best Price in the Industry

We offer competitive pricing based on filing volume. Save time and money while maintaining accuracy and compliance.

Form-based Filing

File directly through our simple form-based interface.

Guided filing

Get clear instructions and real-time assistance to complete your Form 1099-G filing with confidence

Important Deadlines for Filing Form 1099-G

Send Recipient Copies

Deadline: February 02, 2026

Deliver recipient copies on time through ZeroneVault for secure electronic sharing or opt for postal mail.

File with the IRS (e-file)

Deadline: March 31, 2026

Submit your Form 1099-G electronically

File with the IRS (paper)

Deadline: March 02, 2026

Mail your Form 1099-G if filing on paper.

Save time and stress with TaxZerone. File your 1099-G on time and effortlessly.

Start Filing Now!More Time Required to File? Request an Extension

If you need additional time to file or send recipient statements,

you can request an extension using the forms below.

Form 8809

Request an Extension to File Information Returns

- Need extra time to file your form 1099 g? E-file Form 8809 to request an automatic 30-day extension to submit your 1099s to the IRS.

Form 15397

Request an Extension to Furnish Recipient Statements

- Need extra time to provide recipient copies of form 1099 g? File Form 15397 to request a one-time 30-day extension to furnish 1099 recipient statements.

File Extension in Mins

E-file Form 1099-G Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost |

| Total Price: | $0.00 |

| W-2/1099 State Filing | Price Per Form |

|---|---|

| Per Form | $0.99 |

Estimate Your Price

| Enter the number of to calculate your estimated cost |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost |

| Total Price: | $0.00 |

Form 1099-G State Filing

Did you know that some states require separate filings for Form 1099-G in addition to the federal filing?

Ensure compliance with state-specific tax laws by filing in all required jurisdictions.

Schedule Filing: Plan Ahead and Stay On Track

Prepare your Form 1099-G filings in advance, and we’ll take care of submission on the chosen date.

Choose Your Filing Date

Set your preferred filing date, and we’ll ensure timely submission.

Ensure Accuracy

Recipients can review their forms before submission to ensure accuracy.

Avoid IRS Correction Forms

Scheduling in advance reduces the chance of errors, eliminating the need for IRS correction forms later.

Share Recipient Copies with Ease

TaxZerone makes it simple to deliver Form 1099-G copies to your recipients securely and on time.

Choose the method that works best for your business:

Electronic Sharing via ZeroneVault

- Deliver recipient copies securely through ZeroneVault, a user-friendly platform.

- Recipients can access their forms instantly, bypassing the need for printing or mailing.

- Rest easy with ZeroneVault’s advanced data protection for secure sharing of sensitive tax information.

Reliable Postal Mailing

- Prefer physical copies? TaxZerone’s postal service ensures timely delivery of recipient forms.

- Meet IRS deadlines effortlessly with prompt and professional mailing services.

- Save time and reduce effort by allowing TaxZerone to handle the mailing process.

Get Started with TaxZerone Today

Filing Form 1099-G online has never been easier. With TaxZerone, you can:

- File quickly and accurately.

- Stay compliant with IRS requirements.

- Save time with bulk upload.

- File at the best price in the industry.

Start your e-filing process today and complete your Form 1099-G in just 3 simple steps!

Frequently Asked Questions

1. What is 1099 G Form?

2. Who Needs to File Form 1099-G?

3. When is the Deadline to File Form 1099-G?

- Recipient Copy: February 02, 2026

- E-file Deadline: March 31, 2026

- Paper Filing Deadline: March 02, 2026

4. What are the Penalties for Late Filing of Form 1099-G?

- Filed within 30 Days: $60 per form, maximum penalty $683,000 per year ($239,000 for small businesses)

- Filed 31 Days to August 1: $130 per form, maximum penalty $2,049,000 per year ($683,000 for small businesses)

- Filed After August 1 or Not Filed: $340 per form, maximum penalty $4,098,500 per year ($1,366,000 for small businesses)