E- File Form 3922 to report the Stock Transfer easily

Report Employee Stock Purchase Plan (ESPP) stock transfers with our seamless e-filing platform. TaxZerone simplifies the process, ensuring accurate reporting and IRS compliance in just a few clicks.

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

Essential requirements for 3922 Form

- Corporation information: Corporation name, EIN and Address

- Employee information: Employee name, EIN and Address

- Stock purchase and Transfer Details:

- Date of Stock purchase

- Date of Stock Transfer

- Number of shares transferred

- Purchased Price per share

- Fair market value per share on Transfer date

- Account Number (if applicable)

E-File Your 3922 Form in Just 3 Easy Steps

Follow these simple steps to complete your stock transfer filing with TaxZerone.

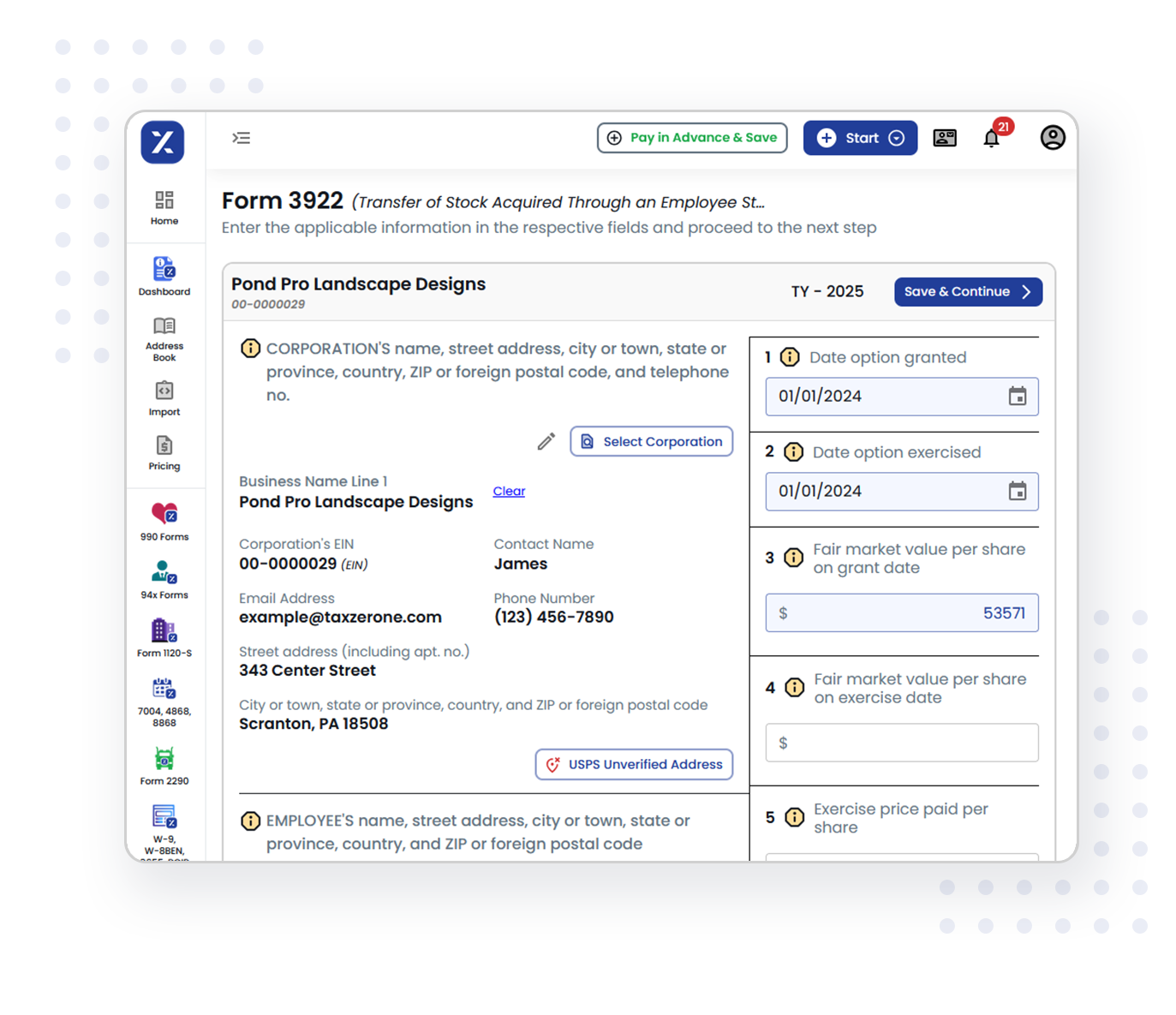

Provide the required Details

Enter the required fields including the corporation (name, EIN and Address), employee (name, EIN and Address) and Stock purchase & Transfer details.

Review and Transmit

Ensure the accuracy with TaxZerone’s IRS validations, then securely e-file your returns.

Send copy to Employee

Securely send the employee’s copy via Zeronevault, ensuring safe sharing or opt postal mail.

Don’t miss the deadline—ensure compliance by filing on time!

E-file Form 3922 Now!Why choose TaxZerone for Form 3922 Filing?

TaxZerone simplifies the stock reporting process with the following advantages

Form Validation

Built-in form validation tools automatically check for errors, ensuring your filing is accurate and compliant with IRS regulations.

User-Friendly Platform

TaxZerone offers an intuitive and easy-to-use interface, making the filing process smooth and straightforward, even for first-time users.

Securely Share Employee Copies

With ZeroneVault, securely store and share employee copies, whether sent digitally or by mail, maintaining privacy and protection.

Bulk Upload for Efficiency

Bulk upload options allow businesses to efficiently file multiple Forms returns at once, saving time and simplifying the process.

Guided E-Filing

With guided e-filing, TaxZerone provides step-by-step instructions, ensuring you file Form 3922 correctly and efficiently, every time.

Best Price in the Industry

TaxZerone provides competitive pricing, offering the best value for businesses looking to file without exceeding their budget.

Important deadline Form 3922 for the Tax year 2025

Employee Copy deadline

Deadline: February 2, 2026

Send employee copy by the deadline so they can accurately report their ESPP stock purchases when filing their taxes.

IRS Paper Filing Deadline

Deadline: March 2, 2026

If you choose to file paper copies with the IRS, make sure to submit them by this date to avoid penalties.

IRS eFile Deadline

Deadline: March 31, 2026

Submit your ESPP transfer document electronically to the IRS by this specified date to avoid penalties.

Submit Form 3922 on time without Hassle!

Start Filing Form 3922 Now!Running Out of Time? File for an Extension

Get additional time to file or send recipient copies by requesting an extension below.

Form 8809

Request an Extension to File Information Returns

- Need more time to file your Form 3922? E-file Form 8809 to request an automatic 30-day extension to file Form 3922 with the IRS.

Form 15397

Request an Extension to File Information Returns

- Need more time to send recipient copies of Form 3922? File Form 15397 to request a one-time 30-day extension to furnish 3922 recipient statements.

File Extension in Mins

Get Started today with TaxZerone!

Filing Form 3922 has never been easier. With TaxZerone you can:

- File effortlessly and accurately

- Easy to manage bulk upload

- Saves time and minimize the error

- Affordable pricing

Start your e-filing today and complete Form 3922 in just 3 simple steps!

Frequently Asked Questions

1. What is Form 3922 used for?

2. When is Form 3922 issued?

Employers must issue Form 3922 if:

- An employee exercises an option under an ESPP,

- The option price was less than 100% of the stock's fair market value (FMV) on the grant date, or

- The option price was not fixed or determinable on the grant date

3. What do I do with Form 3922?

It helps you:

- Calculate your cost basis

- Report any capital gains or losses

- Determine if you owe any ordinary income tax

4. Where do find Form 3922?

You can find Form 3922 and file it with ease using TaxZerone. Simply visit the TaxZerone platform, where you can complete the form electronically and e-file it directly to the IRS, ensuring a smooth and secure filing process.