E-File Form W-2G Online

Looking to report gambling winnings? File Form W-2G accurately with our IRS-authorized e-file service.

We support tax years 2025, and 2024.

Affordable Pricing

Starting at just $2.49, with prices as low as $0.59 per form for bulk filings.

For your return volume

What is Form W-2G?

Form W-2G is a tax document used to report certain gambling winnings to the IRS. It's issued when gambling winnings exceed specific thresholds, which vary by type of gambling (bingo, keno, etc.). The form includes the amount won, federal income tax withheld, and the payer's information. Winners receive this form from the gambling establishment for tax reporting purposes.

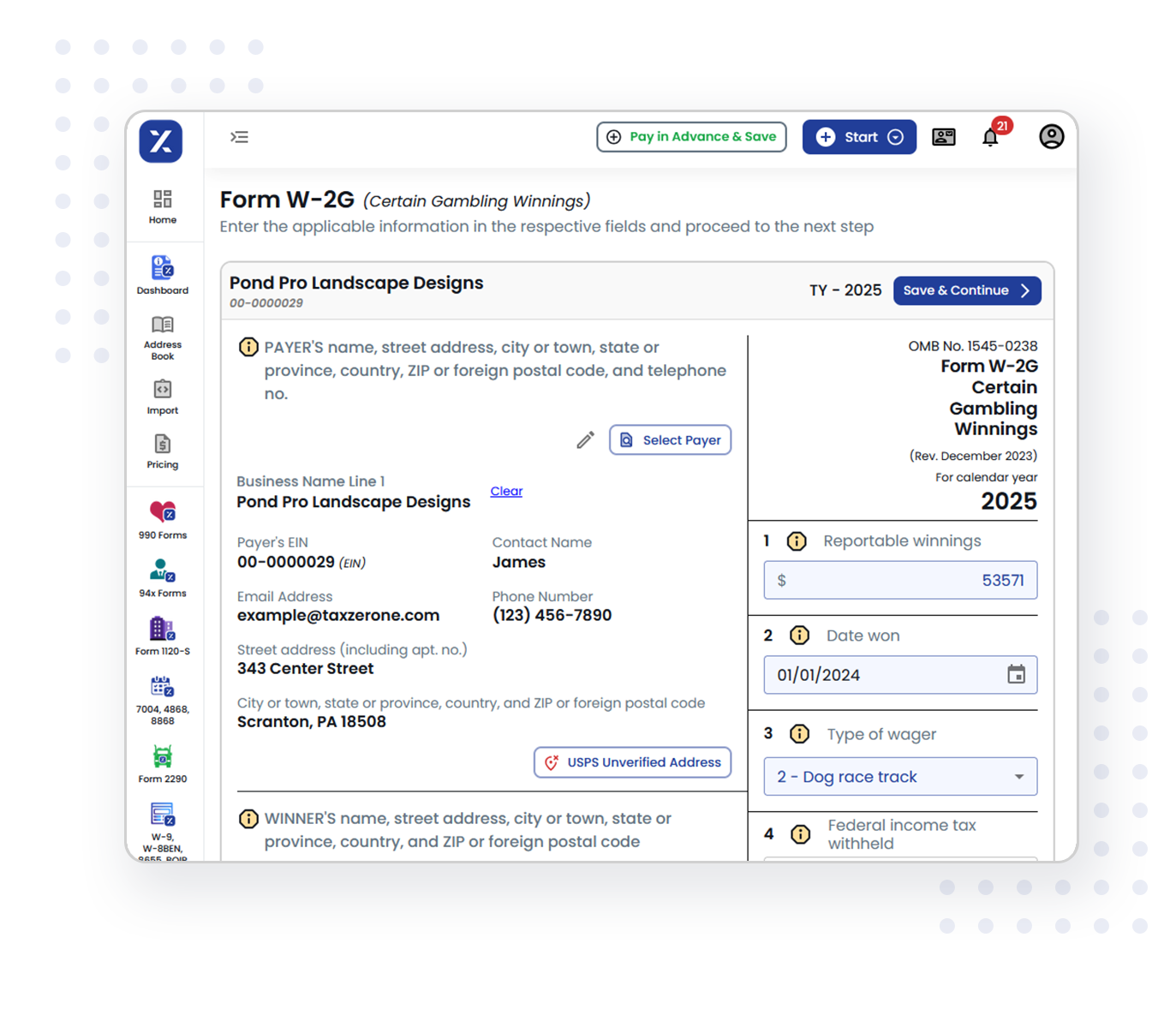

How to Complete IRS Form W-2G in 3 Easy Steps with TaxZerone?

Filing Form W-2G electronically with TaxZerone is quick and simple:

Enter Payer & Winner Details

Provide the payer’s EIN, name, and address, along with the winner’s SSN, name, and address.

Report Winnings & Withholding

Enter the total gambling winnings and any federal or state tax withheld.

Review & Transmit

Securely review your return for accuracy and transmit it to the IRS and state with ease.

Why Choose TaxZerone for file Form W-2G online?

TaxZerone is the trusted e-filing solution for reporting gambling winnings. Here’s why:

IRS Form Validations

Our system automatically checks for errors and missing details, ensuring your Form W-2G submission is accurate and IRS-compliant. Reduce rejections and avoid penalties with our built-in validation.

Bulk Filing Support

Easily upload and file multiple Form at once, saving time and effort. Whether you're reporting a few winners or handling large-scale filings, our bulk upload feature streamlines the process.

Instant Recipient Copy Sharing

Send recipient copies effortlessly via ZeroneVault for secure digital access or opt for traditional postal mailing. No more printing hassles—deliver copies quickly and reliably.

Best Pricing in the Industry

Enjoy affordable pricing tailored to your filing volume. Whether filing a single form or handling bulk submissions, TaxZerone offers cost-effective solutions without compromising quality.

Simple Form-Based Filing

Our intuitive platform lets you enter required details seamlessly. Just fill in the fields, and we’ll take care of the rest—no complex processes involved.

Guided Filing Assistance

Need help with a specific field? Our step-by-step guidance, real-time prompts, and support ensure you complete your Form W-2G filing with confidence.

Form W-2G Filing Deadline for the 2025 Tax Year

Send Recipient Copies

Deadline: February 2, 2026

File with the IRS (e-file)

Deadline: March 31, 2026

File with the IRS (paper)

Deadline: March 2, 2026

Submit your W-2G on time without hassle.

Start Filing Now!Running Out of Time? File for an Extension

Get additional time to file or send recipient copies by requesting an extension below.

Form 8809

Request an Extension to File Information Returns

- Running out of time to file Certain Gambling Winnings? File Form 8809 electronically to obtain an automatic 30-day IRS extension to file Form W-2G with the IRS.

Form 15397

Request an Extension to File Information Returns

- Running out of time to furnish recipient copies of w2g form? File Form 15397 to request a one-time 30-day extension to provide W2G recipient statements.

File Extension in Mins

Why Get Started with TaxZerone Today?

Filing Form W-2G online is fast and hassle-free with TaxZerone. You can:

- File quickly and accurately.

- Stay compliant with IRS requirements.

- Access your documents securely anytime with ZeroneVault.

- Save time with bulk upload.

- Enjoy the best pricing in the industry.

- Benefit from expert support every step of the way.

Start your e-filing today and complete Form W-2G in just 3 simple steps!

Frequently Asked Questions

1. What types of gambling winnings require Form W-2G?

| Type of Gambling | Threshold for W-2G Reporting |

|---|---|

| Horse Racing, Dog Racing, Jai Alai, & Similar | $600 or more and at least 300 times the wager |

| Sweepstakes, Wagering Pools, Lotteries | $600 or more and at least 300 times the wager |

| Bingo/Slot Machines | $1,200 or more |

| Keno | $1,500 or more after deducting the wager |

| Poker Tournaments | $5,000 or more in winnings (after buy-in) |

2. Do I need to pay taxes on my gambling winnings?

3. Can I e-file Form W-2G for multiple winners at once?

4. What if I make an error on Form W-2G after filing?

Mistakes happen, but they can be corrected. If you discover an error in the originally filed Form W-2G, you must submit a corrected version to the IRS. TaxZerone simplifies the correction process, allowing you to quickly amend mistakes and ensure accurate reporting.

5. When is the deadline to file Form W-2G?

6. How do I know if federal tax withholding applies to my winnings?

7. What information is required to file Form W-2G?

- Payer Details: Name, address, TIN, and contact information.

- Winner’s Details: Name, address, and TIN.

- Winnings Info: Total winnings, date won, and type of wager.

- Tax Withholding: Amount of federal and state tax withheld (if any).

- Transaction Info: Wager amount and any backup withholding details (if applicable)

Still have questions?

If you're looking for more answers, refer to our Knowledge Base & FAQs page or get in touch with our customer support team.

Contact us