Generate Your

Paystubs Online with Ease

Conveniently create professional paystubs in minutes with our secure online paystub generator.

It take less than 5 minutes

What is a paystub generator?

A paystub is a document issued by an employer to an employee, accompanying their paycheck. It outlines details of the employee's earnings and deductions for a specific pay period, including gross wages, taxes withheld, deductions for benefits, and net pay.

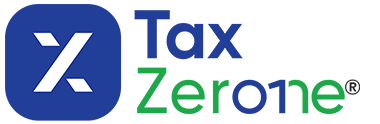

How does our paystub generator work?

Generate accurate paystubs in just three simple steps using our online paystub generator.

Enter Information

Provide details such as your organization’s name, working hours, and salary information.

Choose a Paystub Template & Preview:

Select your preferred paystub template and preview your salary statement.

Download & Print Your Paystub:

Instantly download and print your paycheck stub anytime.

Ready to generate a paystub?

Why Choose Our Paystub Generator?

SecurePayStubs sets itself apart from conventional paystub generators by automating and accurately calculating all relevant taxes for paystubs. This includes federal taxes as well as those for all 50 states. Simply input your company, employee, and salary details to ensure precise tax calculations without any hassle.

What feature differs from other online paystub generators?

Free Paystub Generator

Get started without any cost and experience the simplicity of creating paystubs online:

- Generate your first paystub absolutely free, with no hidden charges.

- Access all essential features to create a complete and accurate paystub in minutes.

- Perfect for employees, freelancers, and small business owners who want to try before committing.

- Download or preview your free paystub instantly to check accuracy and formatting.

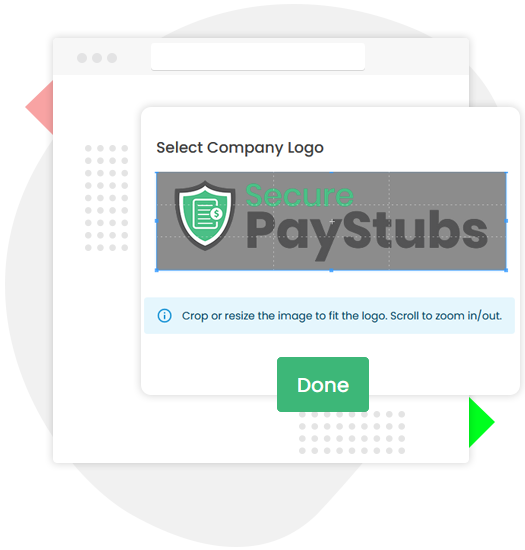

Accurate tax calculations

Our paystub generator ensures Accurate tax calculations, including:

- Federal taxes, covering federal income tax and FICA taxes.

- State taxes across all 50 states, including income tax and disability insurance.

- Local income taxes, ensuring accurate deductions based on your location.

Customize paystubs

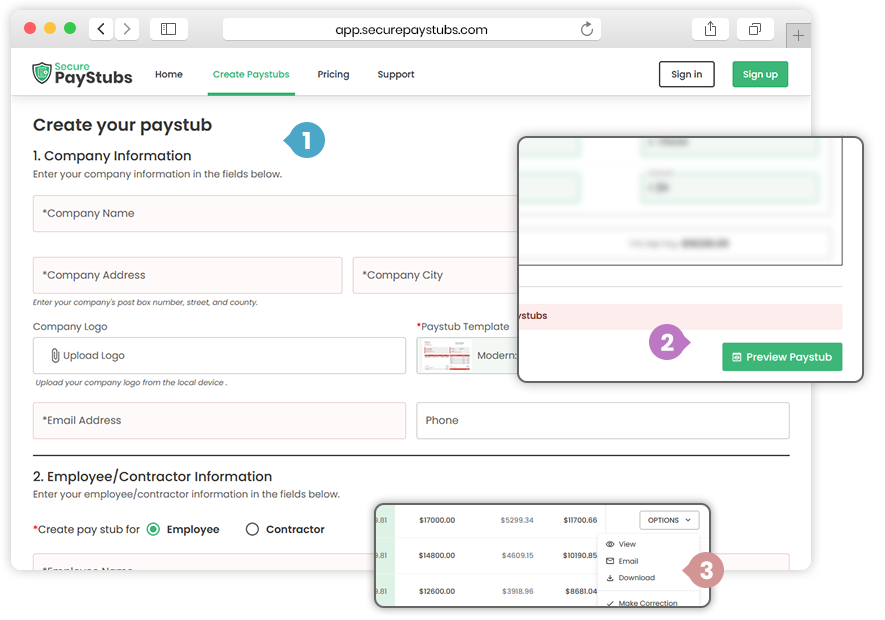

Create professional paystubs that match your needs:

- Select from a variety of paystub templates to suit your preference.

- Personalize your paystub by adding your business logo for a professional touch.

- Easily include essential details such as check number, deposit slip, and time-off information to ensure comprehensive documentation.

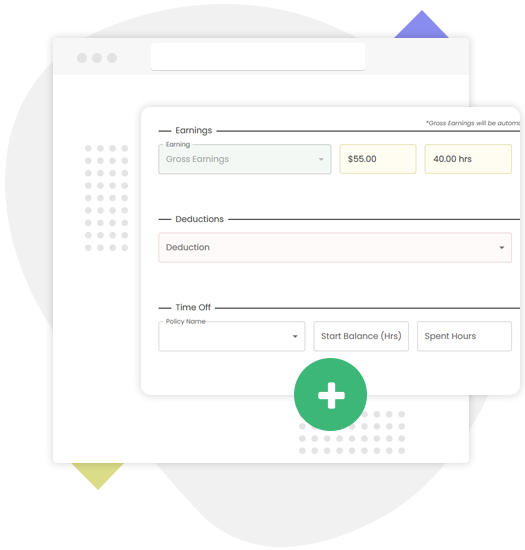

Earnings and deductions

Easily tailor paystubs with detailed earnings and deductions:

- Easily incorporate additional earnings like overtime, tips, bonuses, and more.

- Seamlessly include deductions such as 401(k) contributions, insurance premiums, FSAs, and other benefits.

- Enjoy the flexibility of adding custom earnings and deductions to tailor paystubs to specific needs and preferences.

Who is SecurePayStubs?

SecurePayStubs is an online paystub generator that helps small businesses to create pay stubs for their employees and contractors accurately and instantly. With our extensive features, you can create a pay stub with accurate taxes for federal and all the 50 states. SecurePayStubs is the sister product of TaxZerone.

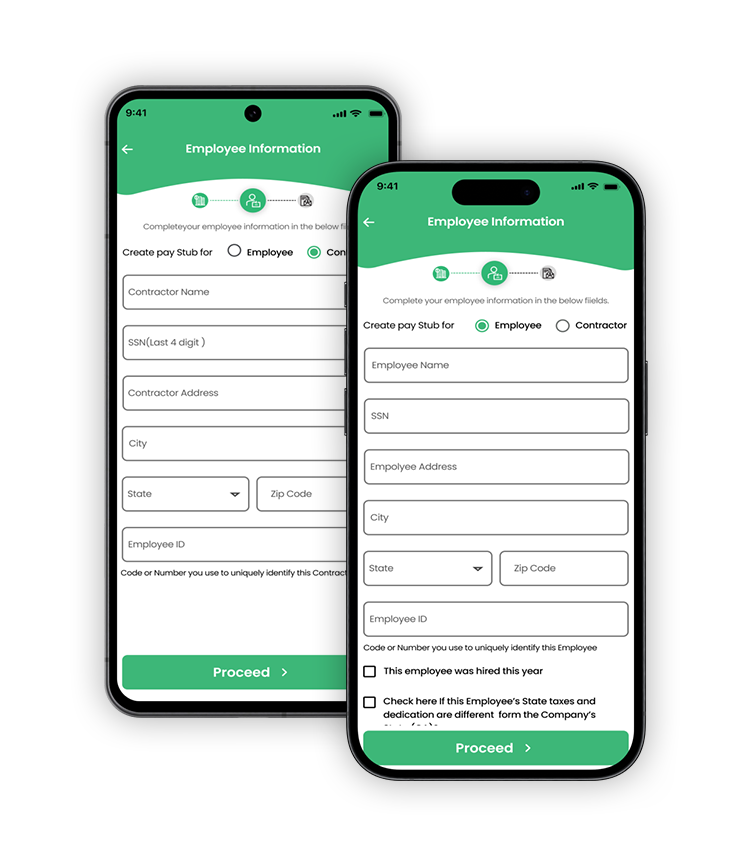

SecurePayStubs is also available as a mobile app

Easily generate and email accurate paystubs for employees and independent contractors on the go. Our mobile app supports both iOS and Android devices.

Get started now by installing the app!

Experience the simplicity and professionalism of our online paystub generator, SecurePayStubs.

Create accurate tax information effortlessly now!

FAQs

1. What information do I need to generate a paystub?

2. Can I create a pay stub for free?

3. What are the best paystub generators?

4. Is it legal to use a paystub generator?

Using a paystub generator is legal if it accurately reflects wages and complies with laws. However, creating fake paystubs for fraud is illegal. Make sure your paystubs are accurate and lawful, and seek legal advice if needed.

5. Who needs a paystub?

Paystubs are essential for employees to track earnings, provide proof of income for loans or renting, and for tax purposes. Employers benefit from providing paystubs for transparency and resolving payment discrepancies.

6. Why should I use an online paystub generator?

Using an online paystub generator offers several advantages:

Convenience: Online paystub generators allow you to create pay stubs anytime, anywhere, as long as you have internet access. This is especially useful for freelancers, small business owners, or employees who work remotely.

Time-saving: Generating pay stubs manually can be time-consuming, especially if you have multiple employees or need to create pay stubs frequently. Online generators automate this process, saving you time and effort.

Accuracy: Paystub generators typically have built-in calculations for taxes, deductions, and other payroll components. This reduces the risk of errors compared to manual calculations, ensuring that your pay stubs are accurate and compliant with relevant regulations.

Customization: Many online paystub generators allow you to customize the pay stubs according to your needs. You can include company logos, employee details, specific deductions, and other relevant information to make the pay stubs more professional and personalized.

Cost-effective: Using an online paystub generator can be more cost-effective than hiring an accountant or purchasing expensive payroll software, especially for small businesses or individuals with limited payroll needs.

Overall, using an online paystub generator streamlines the payroll process, saves time and effort, and helps ensure accuracy and compliance with payroll regulations.

7. What does Year to Date (YTD) mean and why is it included in the paystub?

Year to Date (YTD) refers to the period from the beginning of the current calendar year up to the present date. In the context of a paystub, YTD typically refers to various earnings, deductions, and taxes withheld from an employee's pay since the beginning of the year.

YTD information is included on a paystub for several reasons:

Track of Total Earnings: It allows employees to see how much they have earned from the start of the year until the current pay period. This includes wages, salary, bonuses, commissions, and any other forms of compensation.

Understanding Deductions: YTD deductions show the total amount withheld from an employee's pay for taxes, retirement contributions, insurance premiums, and other deductions. This helps employees understand their net pay and how much has been deducted over the course of the year.

Tax Reporting: YTD figures are crucial for tax reporting purposes. Employers use this information to accurately report employees' earnings and deductions to tax authorities, such as the Internal Revenue Service (IRS) in the United States. YTD data ensures that employees' tax withholdings are accurate and helps in the preparation of annual tax returns.

Budgeting and Financial Planning: YTD information provides employees with insights into their overall financial situation for the year. By seeing how much they've earned and how much has been deducted over time, employees can better plan their finances and make informed decisions about budgeting, saving, and spending.

Overall, YTD figures on a paystub serve as a snapshot of an employee's financial performance and help both employees and employers maintain accurate records and comply with tax regulations.