📢 File Your 2025 Tax Extensions Now: 7004 – Business | 4868 – Individual | 8868 – Exempt Organizations

E-file Form 7004, 4868, 8868 & 8809 with IRS securely

E-file TY 2025 IRS extension forms online using TaxZerone and get your returns approved. Also, pay any balance due to the IRS securely using the Electronic Funds Withdrawal (EFW) option.

E-file IRS extension forms

Choose TaxZerone for simple, quick, and secure e-filing.

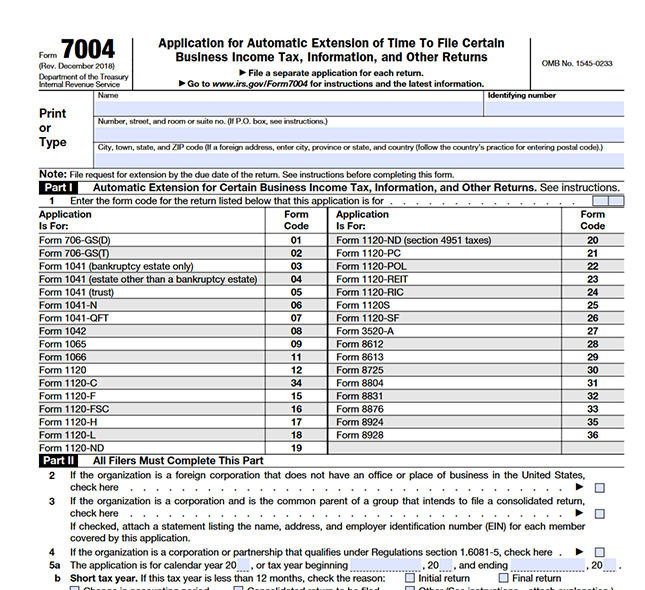

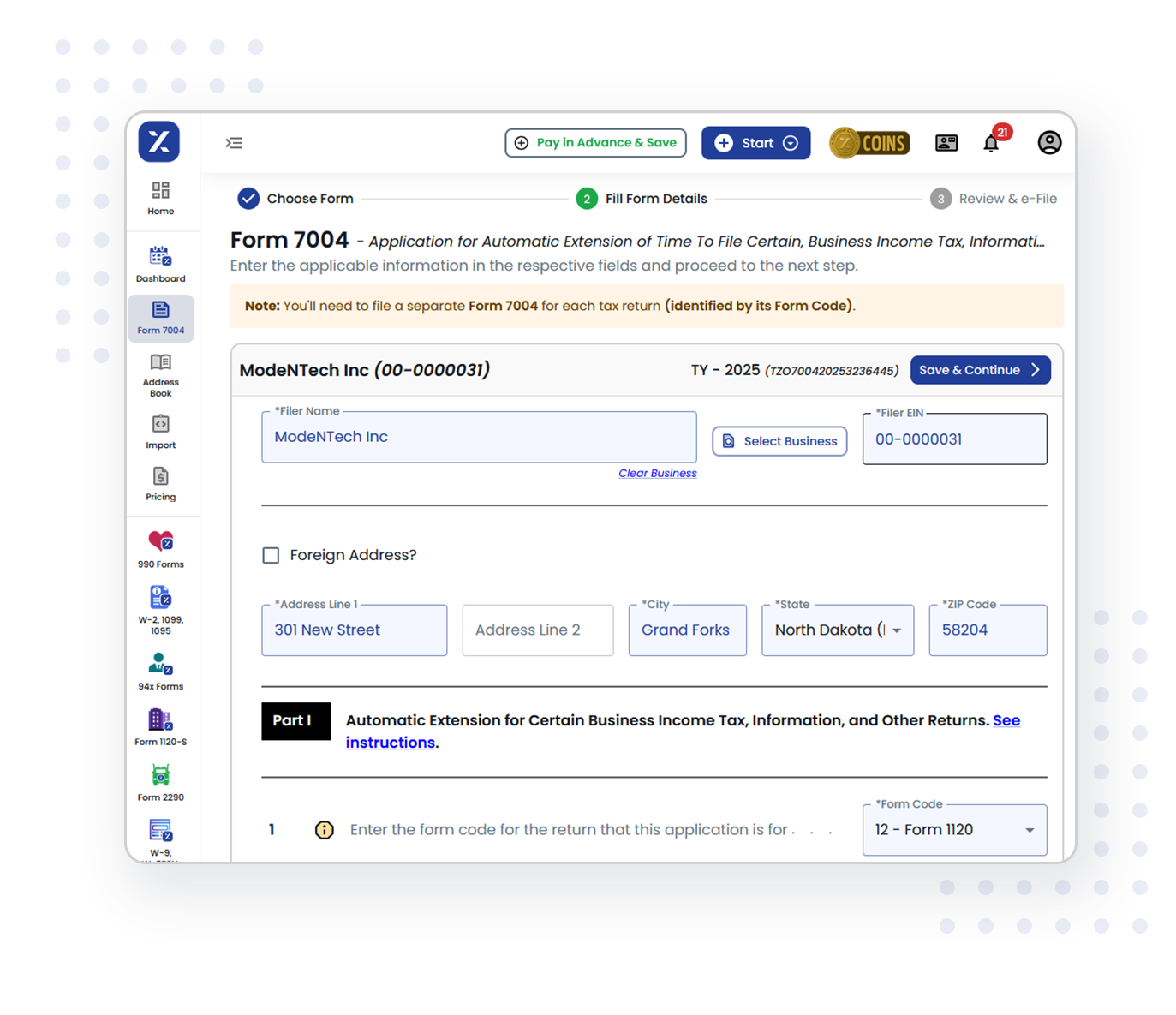

Form 7004

Request an automatic 6-month extension of time to file certain business income tax, information, and other returns with the IRS.

$17.99

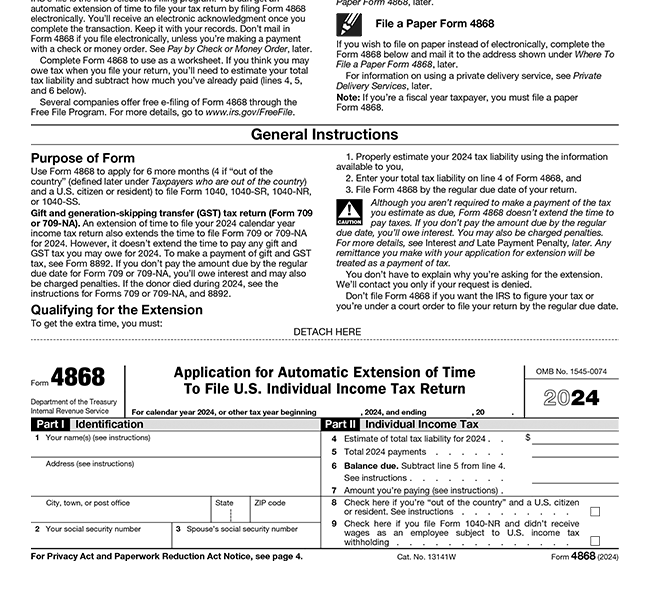

Form 4868

Application for an automatic 6-month extension of time to file a U.S. individual income tax return with the IRS.

$11.99

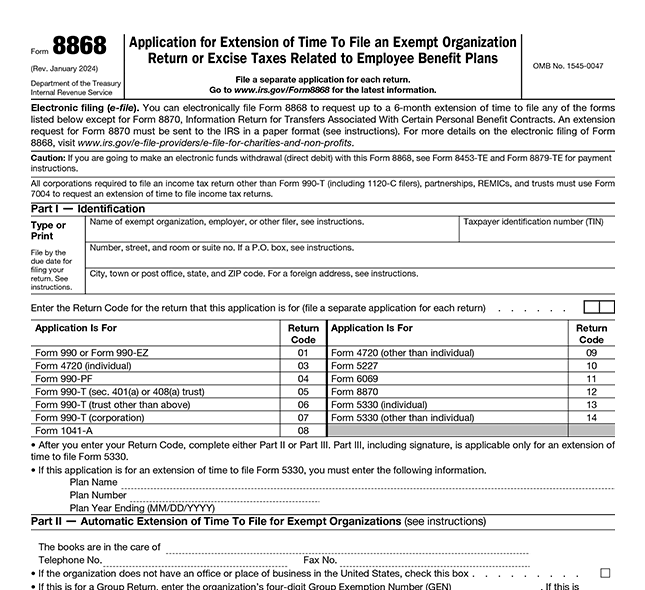

Form 8868

Application for an automatic 6-month extension of time to file an exempt organization return with the IRS.

$14.99

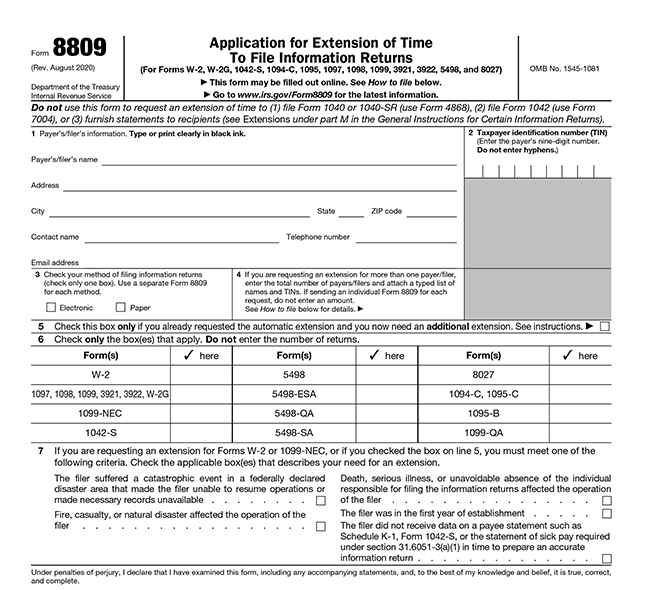

Form 8809

Request an automatic 30-day extension to file certain information returns with the IRS.

$4.99

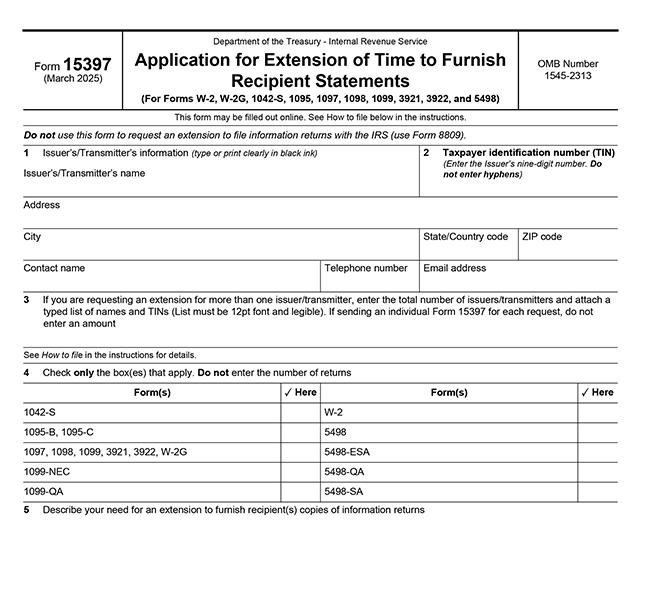

Form 15397

Request a 30-day extension to furnish recipient copies of certain information returns.

$9.99

How to e-file IRS extension forms using TaxZerone?

Follow the easy steps below to file extension forms with the IRS and get extra time to file your returns.

Fill out the form information.

Select the form for which you want to file an extension.

Transmit the extension form to the IRS.

Get notified when the IRS accepts your form or check the status in your TaxZerone account.

Ready to e-file extension forms?

Why choose TaxZerone for e-filing extension forms?

There are countless benefits to filing extension forms using TaxZerone, and

here are the top 3 benefits.

Easy e-Filing

E-file your extension forms with the IRS in a few clicks. Follow the step-by-step instructions to e-file and pay the balance due securely.

Authorized by IRS

TaxZerone is an IRS-authorized e-file service provider, so you can securely file your returns with the IRS online.

Real-time return updates

Get notified of your return status as soon as the IRS accepts it. You also have the option to check the status from your TaxZerone account.