📢 Form 8868 E-Filing Is Open for TY 2025! File Your Exempt Organization Tax Extension with Confidence.

E-File Extension Form 8868 for Tax Year 2025

Worried about not being able to file your 990 return on time?

E-file Form 8868 online in minutes and get an extension of

up to 6 months to file your 990 return.

Takes 3 steps and less than 5 minutes

E-File an extension Form 8868 for as low as just $14.99

You can enjoy the benefit of FREE Form 8868 filing by prepaying for your 990 e-filing.

Why Choose TaxZerone to e-file extension Form 8868?

TaxZerone simplifies the nonprofit tax extension filing with these amazing features

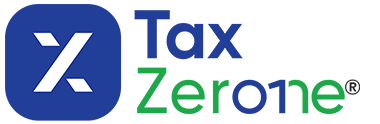

Form-based Filing

With the form-based filing style, it will be as easy as filling out a physical form. You will just have to type out the required information.

E-file in Minutes

Complete your entire Form 8868 e-filing process in less than 5 minutes! You only need to complete 3 simple steps and your extension form will be filed.

Guided Filing

With our step-by-step Form 8868 instructions, you can complete your nonprofit extension filing in just a few clicks. Help is available along the way.

IRS Form Validations

Your return gets validated against every IRS rule while you file your extension. This minimizes the chance of your return's rejection.

Get Instant Form Updates

Receive instant notifications on your return status as soon as the IRS processes your return. You can also check the return status from your TaxZerone account.

Transmit Rejected Returns for Free

In case the IRS rejected your 8868 extension form, you can correct the errors and retransmit the form free of cost!

Get an automatic extension of up to 6 months by filing

extension Form 8868 in just 3 simple steps

Follow the steps provided below to complete the nonprofit tax extension filing with the IRS.

Enter your Organization Details

Enter your business details, and select the tax year and the appropriate tax form to file an extension.

Calculate and Pay the Tax Due

Enter the tax amount paid for the calendar year and calculate the balance due. Choose to pay the balance due amount using the EFW option.

Review the Form and Transmit it to the IRS

Preview the return for any errors and then transmit the form to the IRS. Then, wait for an email notification from us on the status of your return.

Ready to file Form 8868 with TaxZerone? Complete the filing process of your extension Form 8868.

You are just 3 steps away from getting an extension.

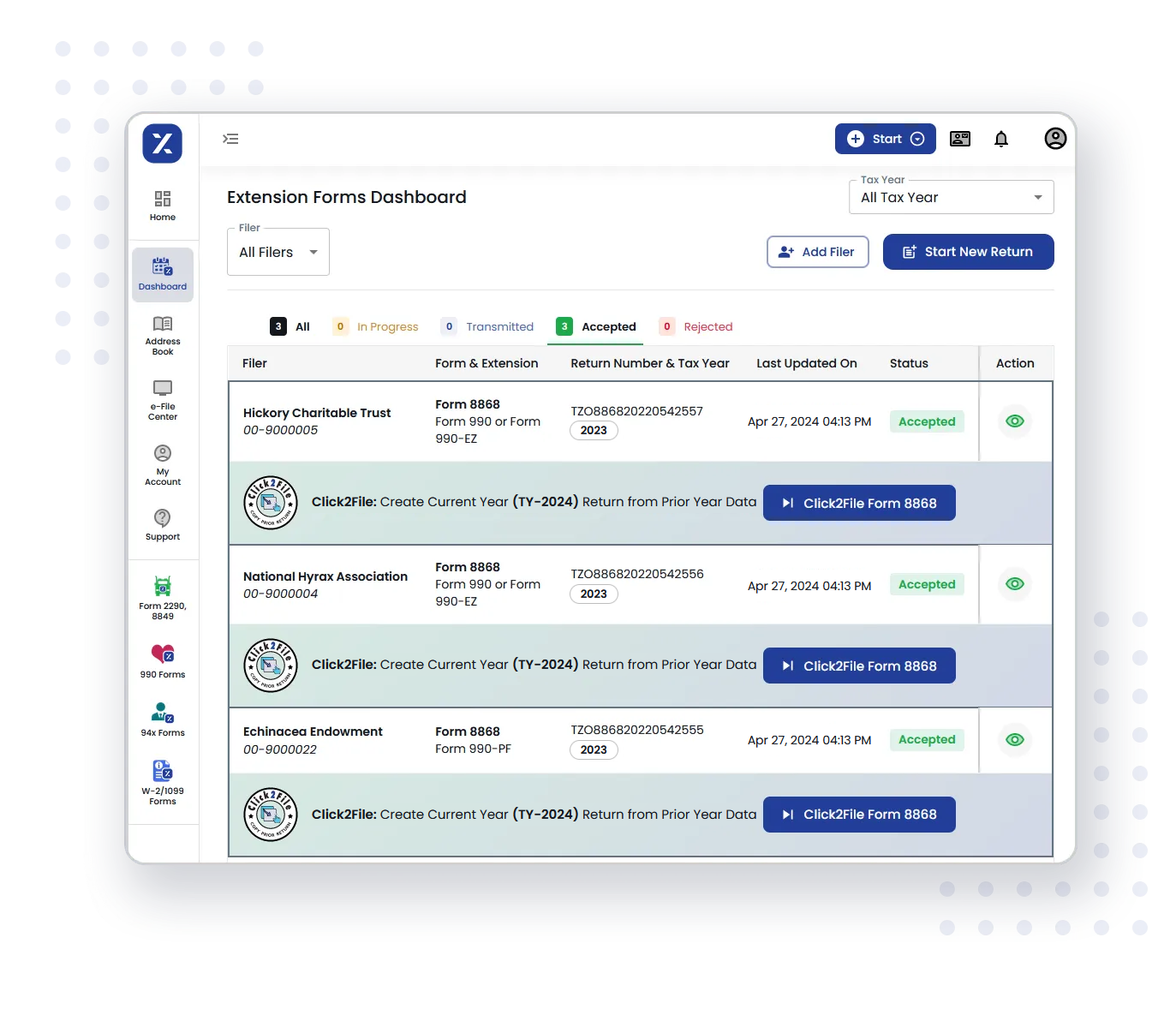

Click2File: Create Current Year Return from Prior Year Data

Tax Season Simplified:

Pre-Populate Your Current Return with Click2File!

Click2File takes the hassle out of tax preparation by automatically transferring relevant data from your previous return to your current one.

How it Works

Login and Select:

Simply access your TaxZerone account and choose Click2File Form 8868.

Review and Customize:

Click2File automatically populates your current return with relevant details. Review and adjust anything to reflect your current financial situation.

File with Ease:

Once everything is perfect, submit your return electronically. Click2File makes filing a breeze!

Experience the convenience of Click2File

Avoid the stress of last-minute filing and the

risk of missing your 990 filing deadline!

E-file Form 8868 with TaxZerone and get a 6 months extension to file your 990 return.

Simple. Secure. Accurate.

FAQs on Form 8868

1. What is IRS Form 8868?

2. When is the deadline for Form 8868?

If your exempt organization follows the calendar tax year, the filing date for Form 8868 deadline is May 15, 2026, and it extends your deadline to October 15, 2026. Form 8868 must be filed by the 15th day of the fifth month following the end of your fiscal year for organizations that use a fiscal tax year.

3. Who must file an extension form 8868?

4. How do I file Form 8868 electronically?

Filing Form 8868 electronically will take only a few steps and minutes. You will only need to enter your organization details, choose the tax form for which you're filing an extension, calculate the balance tax due if any, and transmit the return to the IRS. Once the IRS processes your return, you will receive a notification of its status.