Form 943 Instructions

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 943 is used by employers to report agricultural employment taxes annually. This form reports wages paid to farmworkers and the taxes withheld from their wages, including:

- Social Security and Medicare Taxes: Report the employer and employee portions of Social Security and Medicare taxes.

- Federal Income Tax Withholding: Report any federal income tax withheld from the employees' wages.

- Advance Earned Income Credit (EIC) Payments: If applicable, report any EIC payments made to employees.

Table of Contents

Who needs to file Form 943?

- Employers who pay wages to one or more farmworkers are subject to federal income tax withholding or Social Security and Medicare taxes must file Form 943.

- Once you file Form 943, you must continue to file it annually even if you have no taxes to report, until you file a final return.

Wage Tests:

- $150 Test: Pay an employee $150 or more in a year for farmwork.

- This applies separately to each farmworker.

- Does not include wages paid by other employers.

- $2,500 Test: The total wages (cash and noncash) paid to all farmworkers is $2,500 or more.

- If the group test ($2,500) isn't met, the individual test ($150) still applies, and vice versa.

Exceptions:

- Special rules apply for certain hand-harvest laborers who earn less than $150 annually. See section 4 of Pub. 51 for details.

Final Return:

- If you stop paying wages and don't expect to resume, file a final return. Mark the box above line 1 on the form to indicate no future returns.

- Attach a statement with:

- Name of the person keeping payroll records.

- If sold/transferred: Name, address of the new owner, and sale/transfer date.

- If there is no sale/transfer or if the new owner is unknown, include this information in the statement.

Step-by-Step Instructions:

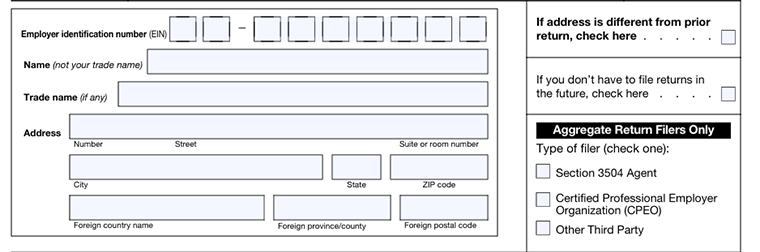

Step 1: Basic Information

- Enter the EIN, Name of your business, trade name (if any), complete address such as number, street, city, state and ZIP code.

- If this mailing address is different than the address you used on your previous Form 943, mark the first checkbox on the right side of the form.

- Mark the second check box only if you expect that you will no longer be required to file returns.

- Aggregate Return Filers Only:

Choose any one box that applies: - Section 3504 Agent — Check this if you are an employer agent who is filing on behalf of clients under section 3504.

- Certified Professional Employer Organization (CPEO) — check this if a CPEO is filing this return on behalf of the client.

- Other Third Party — Check this box, if you are a third-party filer.

- If you are not an aggregate filer, leave these boxes blank.

Step 2: Calculate Wages and Taxes

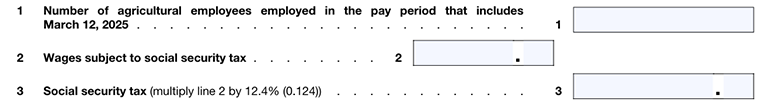

Line 1: Enter the number of agricultural employees on your payroll during the pay period, including March 12, 2025. Do not include household employees, employees in nonpay status during the pay period, pensioners, or active members of the U.S. Armed Forces.

Line 2: Enter the total cash wages, sick pay, and taxable fringe benefits subject to social security taxes that you paid to employees for farmwork during the calendar year.

Line 3: Enter the Social Security tax, 12.4% of the amount on line 2.

Line 4: Total wages paid, including qualified leave.

Line 5: Multiply line 4 by 2.9%.

Line 6: Wages subject to Additional Medicare tax (over $200,000).

Line 7: Multiply line 6 by 0.9%.

Line 8: Total federal income tax withheld.

Line 9: Enter the total of the Social Security tax (line 3), Medicare tax (line 5), Additional Medicare Tax withholding (line 7), and federal income tax withheld (line 8).

Line 10: Round fractions and add uncollected sick pay or life insurance payments.

Line 11: Combine lines 9 and 10.

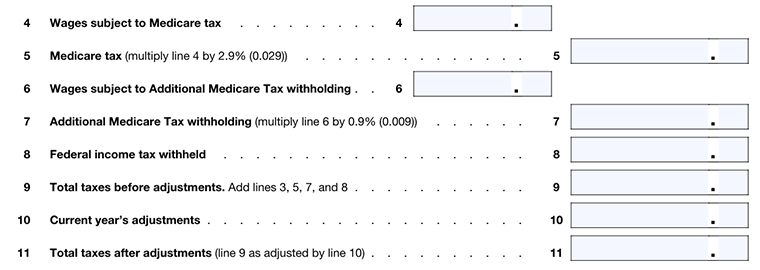

Line 12: Enter the amount of the credit from Form 8974(Qualified Small Business Payroll Tax Credit for Increasing Research Activities), line 12 or line 17. If you enter an amount on line 12, attach Form 8974

Line 13: Enter the result of subtracting line 12 from line 11 on line 13. The amount on line 13 cannot be less than zero.

Line 14: Enter the total deposits for this year, including any overpayment applied from filing Form 943-X and any overpayment from a previous period applied to this return.

Line 15: If line 13 is more than line 14, enter the difference on line 15.

Line 16a: If Line 14 is greater than Line 13, enter the difference on line 16a.

Line 16b: If you have an overpayment, select whether you want the amount applied to your next return or as a refund.

Line 16c: Enter the routing number

Line 16d: Check the account type – checking or savings

Line 16e: Enter the account number

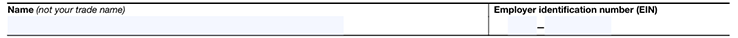

Enter the legal name and EIN of the business.

Line 17: Enter the amount on line 17 only if you were a monthly schedule depositor for the entire year and your line 13 amount is $2,500 or more. The amount on line 17 must match the amount on line 13. If you were a semiweekly scheduled depositor at any point during the year, do not complete line 17. Instead, complete Form 943-A.

Enter the total tax withheld for the month of January(17a), February(17b), March(17c), April(17d), May(17e), June(17f), July(17g), August(17h), September(17i), October(17j), November(17k), and December(17l). Enter the total liability on Line 17m.

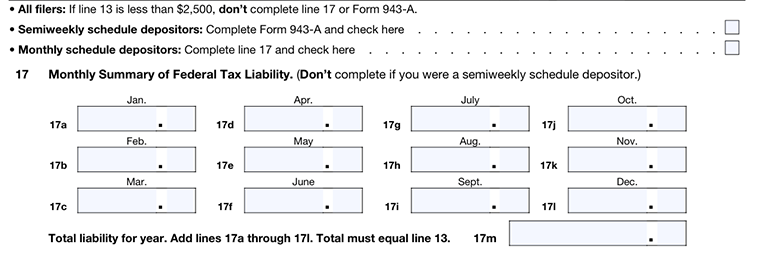

Third-party designee: If an employee, a paid tax preparer, or another person wishes to discuss Form 943 with the IRS, select the "Yes" box in the Third-Party Designee section and provide the necessary information.

Sign here: To declare, sign, enter the date, and print the name and title.

Paid Preparer: If the preparer was paid to prepare Form 943 and is not an employee of the filing entity, they must fill it out this section.