Form 945 Instructions

IRS Form 945 is an Annual Return of Withheld Federal Income Tax form. Businesses need to file this form to report the nonpayroll payments made by the employer during the tax year and the tax withheld from these nonpayroll payments.

Who must file Form 945?

Businesses withholding taxes from the nonpayroll payment should file form 945 to the Internal Revenue Service. You may need to file Form 945-A if you are a semiweekly depositor of the taxes.

Important dates

The deadline for filing Form 945 is January 31st of every year. If the deadline falls on a weekend or holiday, it is extended to the following working day. If you paid the full taxes for the year on time, you can file the return by February 10, 2026, for the tax year 2025.

Filing methods supported by Form 945

- E-Filing: The IRS recommends Employers file form 945, Annual Return of Withheld Federal Income Tax to file using the Electronic filing method.

- Paper filing: The Employer can file form 945 using the paper filing method by completing the form and mailing it to the respective address based on the state from where you are filing.

TaxZerone recommends E-filing of Form 945 for easy filing and faster processing of your employment forms

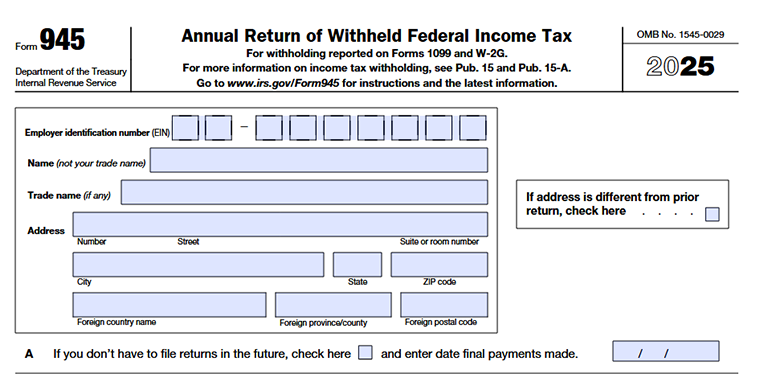

Important information required in Form 945

To file Form 945, below is the information typically required:

- Business information such as Name, EIN, and Address

- Federal income tax withheld

- Backup withholding

- Total taxes

- Total deposits

- Balance due

- Overpayment

What’s New for 2025

- Direct Deposit for Refunds: Under Executive Order 14247 issued on March 25, 2025, Form 945 refunds can now be issued by direct deposit, offering a faster and more secure option. You may still choose to apply any overpayment to your next return (see line 6b).

- Electronic Payments Required: Following Executive Order 14247, all Form 945 balance due payments must now be made electronically.

- Online Return Transcripts: Form 945 return transcripts for tax year 2023 and later are available through your IRS Business Tax Account at IRS.gov/BusinessAccount.

Step-by-step instructions to file form 945

Step 1: Enter the employer details

- Employer identification number (EIN): Enter the Unique EIN of your Business

- Name: Provide the legal Business name

- Address: Fill in your Business address such as Street name, City, State or Province name, and ZIP code.

- If the address is different from prior return, check the box on right side of the form.

Line A: If this is the final return (you will not need to file again because you’ve stopped withholding non-payroll tax), check the box on line A and provide the date of final payment.

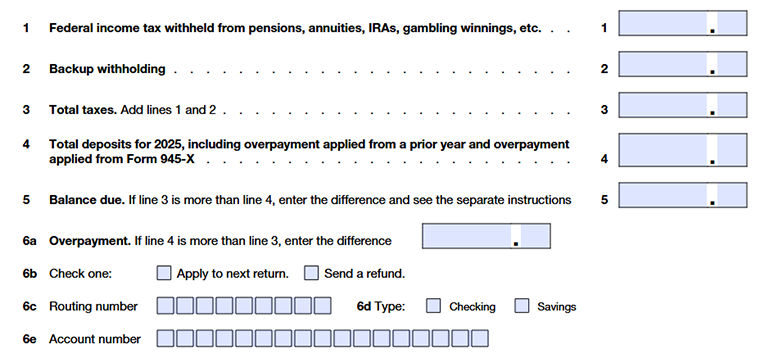

Step 2: Enter tax withheld

Line 1: Enter the total amount of tax withheld from pensions, annuities, IRAs, Military retirement, Gambling winnings, Indian gaming profits, etc., during the tax year.

Line 2: Enter the backup withholding amount for a full year.

Line 3: Add the amount that you entered on Line 1 and Line 2. Now, on Line 3, enter the total amount.

Line 4: Enter the total deposit amount for 2025, including overpayments from Form 945-X and overpayments from a previous year.

Line 5: There is a balance due if Line 3 exceeds Line 4.

Line 6a: If Line 4 is greater than Line 3, enter the difference on line 6a.

Line 6b: If you have an overpayment, select whether you want the amount applied to your next return or as a refund.

Line 6c:Enter the routing number

Line 6d: Check the account type – checking or savings

Line 6e: Enter the account number

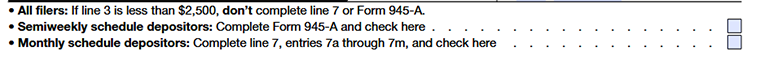

Step 3: Select the Depositor Category

- Select the first check box, if you are a semi-weekly depositor and enter details in

form 945-A - Select the second check box, if you are a monthly scheduled depositor and enter

details in 7 - If your Line 3 is less than $2500, there is no need to fill up the Line 7 or Form 945-A.

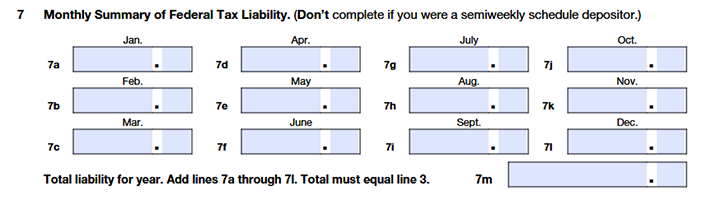

Step 4: Enter the details in line 7 if you are a monthly Depositor

- Enter the total tax withheld for the month of January(7a), February(7b), March(7c), April(7d), May(7e), June(7f), July(7g), August(7h), September(7i), October(7j), November(7k), and December(7l)

- (7m) Add the amount you entered from Line 7a to 7l. You can now put the total amount of taxes withheld for the year in Line 7m. Verify that the total amounts on Lines 3 and 7m are equal.

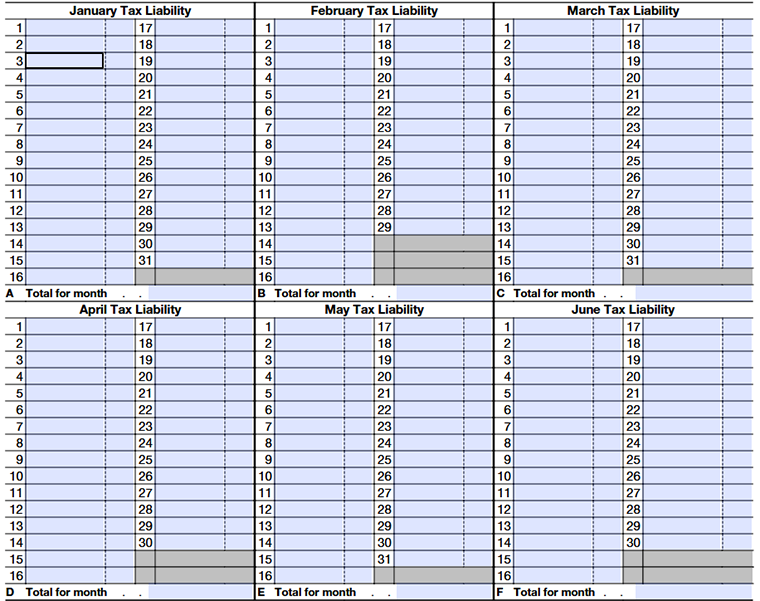

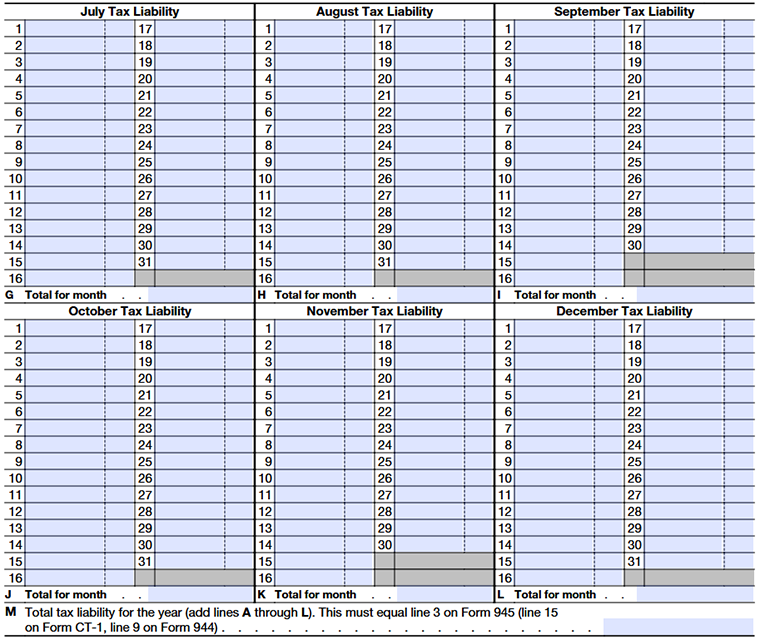

Step 5: Enter the details in form 945-A if you are a semi-weekly Depositor

- Enter the total tax withheld from the employee's wages for each day of the month from January to June.

- Enter the total tax withheld in each month in the respective fields

- Enter the total tax withheld from the employee's wages for each day of the month from July to December.

- Enter the total tax withheld in each month in the respective fields

- Add the taxes mentioned from line A to L and enter the total taxes in line M. The Tax amount should be equal to the taxes mentioned in M and should be equal to line 3 of Form 945

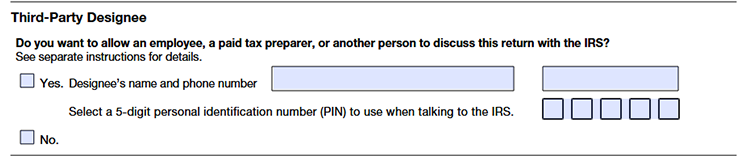

Step 6: Third-Party Designee

If you want to allow an employee/tax preparer/another person to discuss your return with the IRS, check “Yes” and enter the designee’s name, phone number, and a 5-digit PIN. Otherwise, check "No".

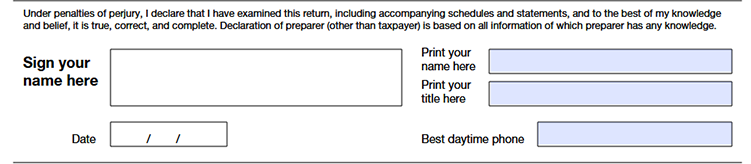

Step 6: Sign the form

- The authorized person to file the return should sign the form along with their name. Also, enter the name, title, date, and mention the best daytime to talk with the IRS.

E file form 945 with Taxzerone

E-File Form 945 easily with Taxzerone for just $6.99 per return.

Start your Form 945 E-filing process with us in 3 simple steps.