Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

If you’ve made certain gambling winnings payouts, you’re required to report them using

IRS Form W-2G. This form is used to report winnings from lotteries, sweepstakes, horse races, casinos, and other wagering activities. Timely and accurate filing helps ensure compliance with IRS regulations and avoids penalties.

Table of Contents

What is Form W-2G?

IRS Form W-2G is an IRS information return used to report certain gambling winnings, and any federal income tax withheld from those winnings. This form is typically issued by organizations like casinos, racetracks, state lotteries, or other gambling operators when a player receives a payout that meets IRS reporting thresholds.

The form helps ensure that both the IRS and the recipient accurately report gambling income on their tax returns. Payers are responsible for completing and furnishing Form W-2G to both the winner and the IRS.

Who needs to file Form W-2G?

Payers (such as casinos, lotteries, racetracks, or any organization that pays out qualifying gambling winnings) are the ones required to file Form W-2G. They file it on behalf of the winners to report the amount won and any taxes withheld.

Form W-2G must be filed when the winnings meet or exceed the following thresholds:

- $1,200 or more from a slot machine or bingo game (not reduced by wager).

- $1,500 or more from a keno game (reduced by the wager).

- $5,000 or more from a poker tournament (reduced by the buy-in or entry fee).

- $600 or more and at least 300 times the wager from other gambling activities (reduced by the wager at the payer's discretion).

- Any winnings subject to federal income tax withholding (either regular or backup withholding)

Important key deadline to file Form W-2G?

The form W-2G deadline is given below:

| Filing Type | Deadlines |

|---|---|

| Sending Winner’s copy | February 2, 2026 |

| Paper filing | March 2, 2026 |

| IRS e-filing | March 31, 2026 |

Form W-2G Instructions-How to fill out?

Let's see detailed instructions to fill out Form W-2G

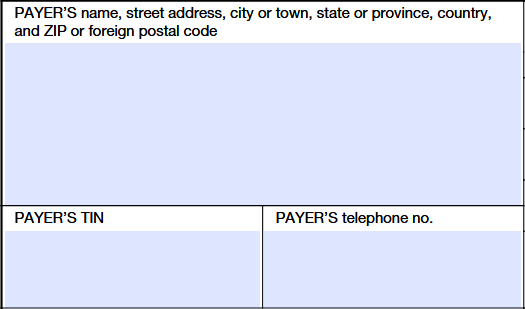

Step 1: Enter the Payer’s details

Enter the payer’s name, address and Taxpayer Identification number (TIN) along with the telephone number to ensure accurate reporting and communication of the form submission.

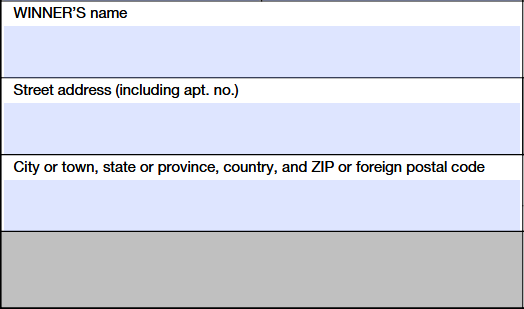

Step 2: Enter the Winner’s details

Enter the winner’s name, address including apartment number, city, state, country and Zip code.

Step 3: Gambling Winnings details

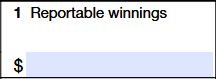

Box 1: Reportable Winnings

Enter the total amount of gambling winnings won by the winner.

Box 2: Date won

Enter the exact date when the winnings are earned (MM/DD/YYYY format).

Box 3: Type of Wager

Specify the type of wager. Common examples include:

| Horse racing | Dog racing |

| Jai alai | Sweepstakes |

| Wagering pools | Lotteries |

| Bingo | Keno |

| Slot machines | And any other type of gambling's |

Box 4: Federal Income tax withheld

Enter any federal income tax withheld from the winnings, if applicable.

Box 5: Transaction

Enter the ticket or transaction number related to the winning wager.

Box 6: Race

If the winnings came from horse or dog racing, include the race number.

Box 7: Winnings from identical wagers

Enter the total amount won from identical wagers grouped together.

Box 8: Cashier

Enter the name or ID number of the cashier who paid out the winnings.

Box 9: Winner’s TIN

Enter the winner’s Taxpayer Identification Number, usually Social Security Number (SSN).

Box 10: Window

Enter the window number or payout location at which the winnings were issued.

Box 11: First Identification Number

Enter the winner's first identification number.

Box 12: Second Identification Number

Enter the second identification number provided by the winner at the time of payment, such as a driver’s license, passport, or state-issued ID.

Box 13: State/Payer’s State Identification Number

Enter the payer’s state abbreviation and the state identification number assigned for state income tax reporting purposes.

Box 14: State Winnings

Enter the amount of gambling winnings that are subject to state income tax.

Box 15: State Income Tax Withheld

Enter the amount of state income tax that was withheld from the winner’s gambling winnings, if any.

Box 16: Local Winnings

Enter any winnings that are subject to local (city or county) income tax.

Box 17: Local Income Tax withheld

Enter the amount of local income tax that was withheld from the winner’s gambling winnings, if any.

Box 18: Name of Locality

Enter the name of the city, town, or other locality that collected local tax.

Ready to file Form W-2G?

Report your gambling winnings easily and on time to stay compliant.